Quota 103: effective guide, application process and pension settlement

The flexible early pension, provided for by Law number 197/2022 (Maneuver 2023) is due to employees, self-employed, enrolled in the substitute and exclusive forms managed by INPS, as well as in the separate management.

Not only. On March 10, the Institute also published the circular with detailed instructions (Inps circular 27 of 10 March 2023) on the functioning of the 2023 flexible pension: start date and pension amount in primis.

The maturation of the requirements is required no later than 31 December 2023, while access to early retirement takes place in compliance with the so-called windows, which differ between employees and self-employed workers on the one hand and Public Administration employees on the other.

We analyze the performance in detail and put pen to paper the update of the check application and settlement procedures.

Who is entitled to the Pension with Quota 103

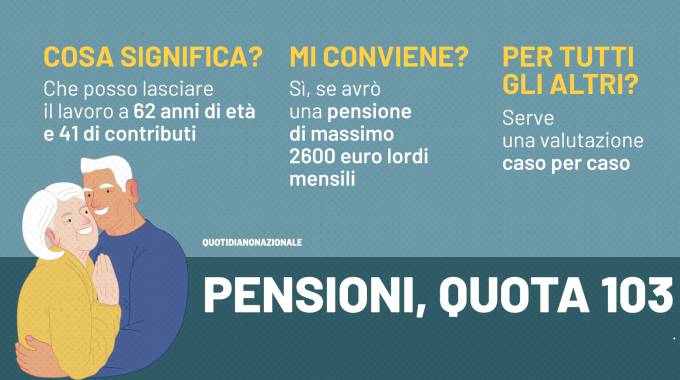

Quota 103 can be accessed by members of the Compulsory General Insurance (AGO) and the exclusive and substitute forms of the same, as well as the Separate Management, who complete, by 31 December 2023, a chronological age of not less than 62 years and a minimum contributory seniority of 41 years.

For the purpose of completing the contribution requirement, the contribution for any reason paid or credited in favor of the insured. The Inps Circular of 10 March 2023 specified) thesimultaneous completion of the requirement of 35 years of contributions net of periods of illness

It should also be noted that the age requirement of 62 is not adequate for increases in life expectancy.

The categories of workers enrolled in the entertainment workers' pension fund, referred to in article 2, paragraph 1, letter a), Legislative Decree 182 of 30 April 1997, with classification in Group A, can access the service in question according to the provisions of referred to in article 66, paragraph 17, letter c), Decree - Law of 25 May 2021 number 73, converted into Law of 23 July 2021 number 106.

Workers excluded from Quota 103

To flexible early retirement they cannot access:

- Personnel belonging to the Armed Forces;

- The personnel of the Police Forces and Prison Police;

- The operational staff of the National Fire Brigade;

- The personnel of the Guardia di Finanza.

To learn more about disputes with INPS regarding unpaid contributions and all other aspects of the relationship between the worker and the social security institution, we recommend the book “The contribution dispute with INPS”.

Quota 103: check amounts

Quota 103 is due in an amount equal to a maximum monthly gross value no more than five times the minimum treatment envisaged by current legislation, for the advance months with respect to the moment in which this right would mature following the achievement of the requirements for access to the pension system pursuant to article 24, paragraph 6, Decree - law number 201/2011 converted, with amendments, by Law number 214/2011.

Consequently, until the requisites for the old-age pension mature, the amount of Quota 103 to be paid cannot exceed the maximum monthly sum, corresponding to five times the minimum treatment established for each year (563.73 * 5 = 2,818.65 euros).

In the event that, underlines the Inps Circular of 10 March 2023, at the time of the payment of the early pension there is a gross monthly amount that is less than five times the minimum treatment and, subsequently, as a result of the reconstitution of the pension, the gross monthly amount exceeds five times the minimum treatment established for each year "the gross monthly amount equal to the so-called maximum payable amount will be paid”.

However, upon reaching the age requirement for the old-age pension, the entire amount of the allowance adjusted over time is paid.

Quota 103: accumulation of insurance periods

The overlapping insurance periods must be assumed only once for the purposes of the right and all valued for the purpose of measuring the pension treatment. If the aforementioned periods coincide, for the purposes of the right to Quota 103, those with the management in which the highest number of contributions are paid or credited must be "neutralized" (Inps Circular).

From when does the payment of Quota 103 start?

Another key point is the effective date of the first pension allowance with quota 103. Employees of employers other than public administrations and self-employed workers:

- Who have accrued the aforementioned requisites by 31 December 2022 obtain the right to the first effective date of the pension treatment from 1 April 2023;

- Those who meet the prescribed requirements starting from 1 January 2023, obtain the right to the first effective date of the pension treatment, three months after the accrual of the requirements.

With reference to the aforementioned workers, where the pension treatment is paid by a management other than the exclusive one of the AGO, the first effective date of the aforementioned treatment is set for the first day of the month following the opening of the window.

Adjustment of application submission procedure

Thanks to the Message dated 21 February 2023 number 754, INPS communicated the implementation of the application management system in order to allow the presentation of the application for access to Quota 103.

Applications can be submitted through the following channels:

- By connecting to the "inps.it" portal in possession of at least level 2 SPID, CNS or CIE credentials, following the path "Pension and social security - Pension application - Thematic area Pension question, Reconstitution, Accruals, ECOCERT, Social APE and Early benefits ”;

- Using the telematic services offered by the Institutes of Patronage recognized by law;

- By calling the Integrated Contact Center on the toll-free number 803.164 (free from a landline) or 06.164.164 (from a mobile network for a fee based on the tariff applied by the various operators).

Quote 103: all about the amounts settlement procedure

The INPS press release of 11 May announced the update of the procedures for the definition of applications for flexible early retirement for workers enrolled in the Compulsory General Insurance (AGO) and in the substitute and exclusive forms managed by the Institute as well as to separate management.

The right to a pension with Quota 103, the INPS recalled, achieved during the current year, allows access to the pension at any time after the opening of the so-called window.

They also remain "confirmed the methods of access to the pension for AFAM and school staff, respectively on 1 November and 1 September of the year in which the requirements are met” (Inps press release). The latter are considered achieved even if completed after the dates indicated but in any case within the calendar year.

Again the INPS, this time with the Message dated 9 May 2023 number 1681, communicated the implementation of the programs for the payment of pensions with Quota 103. In particular, the Cumul - Unicarpe - IVS procedures were updated for the payment and reconstitution of flexible early retirement.

Related news: Quota 103, Green light for the settlement of pensions