THE periods That Not offer the possibility of redemption are those:

- out-of-course enrollment;

- already covered by compulsory or figurative contributions or by redemption which is not only at the fund to which the application is directed, but also in the other social security regimes referred to in article 2, paragraph 1, legislative decree 30 April 1997, n. 184 (Employee Pension Fund and special management of the Fund itself for self-employed workers and replacement and exclusive funds of the Compulsory General Insurance for invalidity, old age and survivors and management referred to in article 2, paragraph 26, law of 8 August 1995, no. 335).

- university diplomas, the courses of which have not lasted less than two or more than three years;

- university degrees whose courses have not lasted less than four or more than six years;

- specialization diplomas obtained after graduation and at the end of a course lasting no less than two years;

- research doctorates whose courses are regulated by specific legal provisions;

- the academic qualifications introduced by the decree of 3 November 1999, n. 509 or Degree (L), at the end of a three-year course and Specialized Degree (LS), at the end of a two-year course preparatory to the degree.

With regard to the diplomas issued by Institutes of Higher Artistic and Musical Education, The new courses activated starting from the 2005/2006 academic year and which give rise to the achievement of the following qualifications can be redeemed for retirement purposes, according to the provisions in force on the matter:

- first level academic diploma;

- second level academic diploma;

- postgraduate diploma;

- academic research training diploma, equivalent to a university research doctorate by article 3, paragraph 6, decree of the President of the Republic July 8, 2005, n. 212 (message 14 June 2010, n. 15662).

The redemption may concern the entire period or individual periods.

From 12 July 1997 it is possible to redeem two or more degree courses, even for qualifications obtained before this date.

It is not possible to ask for the waiver or revocation of the degree redemption fee legitimately accredited following the payment of the related fee (message 8 October 2008, n. 22427).

Periods of university study completed abroad

Periods of university study completed abroad

For periods of university study completed abroad, the law of 11 July 2002, n. 148 (published in the Official Gazette of 25 July 2002, n. 173, SO) orders the ratification and execution of the convention on the recognition of qualifications related to higher education in the European region, made in Lisbon on 11 April 1997, and dictates rules for the adjustment of the internal legal system. The decree of the President of the Republic 30 July 2009, n. 189, in execution of article 5 of the aforementioned law, governs, among other things, the procedure for the recognition of educational qualifications and the related curricula studiorum for social security purposes.

Article 170, paragraph 1, of the consolidated text on higher education referred to in the Royal Decree of 31 August 1933, n. 1592 establishes that i academic qualifications obtained abroad they have no legal value in Italy, except in the case of special law or bilateral agreements.

On the basis of point 1) of the circular of 7 September 1978, n. 468 university qualifications obtained abroad are redeemable if they have been recognized by Italian universities or, in any case, have legal value in Italy. These principles are confirmed for the generality of foreign qualifications but are no longer operative for qualifications to which Presidential Decree 189/2009 is applicable.

In fact, the assessments concerning the recognition for social security purposes of the aforementioned qualifications and the related curricula studiorum have been left to the competence of the Ministry of Education, University and Research (article 1, paragraph 1, and article 3, paragraph 1, letter b), dpr 189/2009).

Therefore, the study periods in question are redeemable pursuant to article 2, legislative decree 30 April 1997, n. 184 only when they are the object of specific recognition for social security purposes pursuant to article 3, paragraph 1, letter b), of Presidential Decree 189/2009. For the specific purpose of admission to the redemption faculty, therefore, other recognitions such as the additional ones envisaged are not relevant, the recognitions for academic purposes referred to in article 2, law 11 July 2002, n. 148 or for the purposes related to professional recognition, provided for by community legislation, and by articles 49 and 50 of the decree of the President of the Republic August 19, 1999, n. 394.

The procedure referred to in Presidential Decree 189/2009 applies exclusively to foreign academic qualifications issued in countries adhering to the "Lisbon Convention of 11 April 1997" (art.1, paragraph 2). If it is necessary to proceed, the territorially competent INPS structure sends the Ministry the express request of the interested party aimed at obtaining recognition of the title "for social security purposes" pursuant to article 3, paragraph 1, letter b), of Presidential Decree 189/2009 , accompanied by the documents indicated in article 3, paragraph 2, Presidential Decree 189/2009.

The redemption of a degree requested by unemployed subjects

The redemption of a degree requested by unemployed subjects can therefore be exercised by subjects not enrolled in any compulsory form of social security who have not started their working activity in Italy or abroad.

The faculty (circular 11 March 2008, n. 29) can be exercised by those who, at the time of the application, have never been enrolled in any compulsory form of social security, including the Separate Management referred to in article 2, paragraph 26, law 8 August 1995, n. 335 and who have not started their working activity, in Italy or abroad (message 9 March 2009, n. 5529).

In the event of a degree redemption requested by unemployed subjects, the burden consists of the payment of a contribution, for each year to be redeemed, equal to the minimum annual taxable level of artisans and traders multiplied by the rate of calculation of pension benefits of the Compulsory General Insurance (AGO), in force in the year in which the application is presented.

The contribution is paid to INPS in specific separate accounting evidence of the Employees Pension Fund (FPLD) and is revalued according to the rules of the contribution system, with reference to the date of the application.

The amount accrued is transferred, upon request by the interested party, to the social security management in which the interested party is or has been registered.

For more information, refer to circular 27 May 2011, n. 77.

The payment of the charge it is carried out using the appropriate bulletins MAV sent by INPS with the acceptance provision.

The bulletins can be paid at any bank counter without additional costs and at all post offices, paying the current postal commission.

Bulletins can be printed MAV online through the dedicated service or alternatively request them from the Contact Center on 803 164, free from a landline, or on 06 164164 from a mobile. In this case, the operators will send a copy of the bulletin to the desired address or by e-mail.

Communicating the file number and the tax code is possible pay in the following ways:

- at entities belonging to the “Reti Amiche” circuit:

- tobacconists participating in the circuit;

- the bank branches of Unicredit SpA, with payment in cash for all users or, for Unicredit account holders, also with debit on the bank current account;

- on the Unicredit SpA website for customers who own the online banking service;

- online on the INPS website using a credit card;

- online from a smartphone or tablet, via the INPS Servizi Mobile application (IOS and Android), using a credit card;

- online from all other mobile devices, via the mobile version of the m.inps.it site, using a credit card;

- by credit card using the Contact Center on 803 164 free from a landline or on 06 164164 from a mobile network.

In the case of payment made through the Contact Center, INPS will send the analytical payment receipt to the address held by the institution.

Payment by installments can also be made by direct debit from the account. Simply go to the bank branch or post office where you have the account and fill out an SDD form. The model must contain the predefined fixed amount option, which implies the waiver of the right to reimbursement of the debit within eight weeks (Legislative Decree 27 January 2010, n. 11).

Payment by installments can also be made by direct debit from the account. Simply go to the bank branch or post office where you have the account and fill out an SDD form. The model must contain the predefined fixed amount option, which implies the waiver of the right to reimbursement of the debit within eight weeks (Legislative Decree 27 January 2010, n. 11).

Once the debit authorization has been communicated, INPS will send a confirmation letter indicating the month of activation of the service and the amounts relating to the deadlines for the year. While waiting for the confirmation letter sent by INPS, you will have to continue making payments using the payment slips MAV or with the other payment methods indicated, respecting the monthly deadlines.

From the date of activation of the service, it will no longer be necessary to use the payment slips with a payment term subsequent to the activation itself.

L'automatic charge it can be revoked by the taxpayer at any time, with timely communication to the bank agency or post office. The remaining installments can be paid with the other payment methods.

At the beginning of the calendar year following the payments, the certification useful for tax purposes can be viewed on the Payment Portal: "Redemptions, Reconjunctions and Annuities" service, "Payments made" section.

For applications submitted after 1 January 2008, the redemption fees for the degree course can be paid to the relevant social security schemes in a single solution or in 120 monthly installments without the application of interest for installments. The possibility is confirmed for the interested party to exercise the right to extinguish the debt even in a smaller number of installments and in any case without the application of interest.

It remains understood that the pensioner will not be able to request payment by installments and that retirement implies the forfeiture of the benefit of any installment payments in progress, with the consequent obligation to pay the residual capital in a single solution.

Failure to pay the amount in a lump sum or to pay the first installment is considered as a waiver of the application which is archived by INPS without further fulfilments.

The renunciation does not preclude the possibility of submitting a new redemption request for the same title and period. In this case, the redemption fee will be recalculated with reference to the date of the new application.

The renunciation does not preclude the possibility of submitting a new redemption request for the same title and period. In this case, the redemption fee will be recalculated with reference to the date of the new application.

For installments subsequent to the first, their payment made after the deadline but with a delay of no more than 30 days, is allowed no more than five times. Further payments made after the deadlines assigned may be, at the explicit request of the interested party, considered as a new request and will result in the recalculation of the amount to be paid.

All payments made for partial amounts or for a smaller number of installments within the assigned terms will be validated by determining the crediting of the insurance period corresponding to the amount paid.

Any changes in address or personal data must be promptly communicated to the Institute.

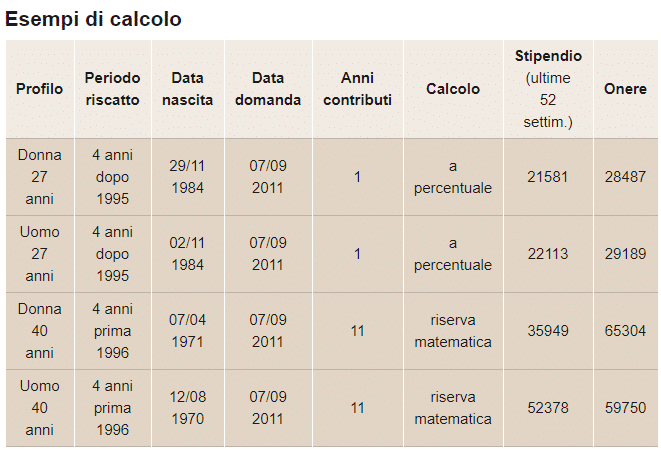

From what has been said, it is clear that it is not possible to establish the cost of the ransom a priori, given that there are various variables that affect the amount.

However, it is necessary to consider a whole series of advantages foreseen in the event of redemption:

- the option to pay through an installment plan;

- the possibility of deducting it as a tax deductible expense;

- the opportunity to bring forward the date of retirement;

- the advantage of increasing the amount of your future pension.

One thing is certain, the sooner you redeem your degree, the more you save. In fact, the coefficient for the calculation increases exponentially over the years. It is therefore better not to wait until you are too close to retirement to proceed with the redemption. In fact, the costs at that point could be prohibitive.

There is a bill that would allow students who enroll from next year (and in subsequent years) to request a free degree redemption.