The season of uncertainty: data and reflections on the generic drug system in Italy in the Observatory

Nomisma Observatory on the generic drug system in Italy 2022

Nomisma on the generic drug system in Italy 2021

The dramatic rise in the prices of raw materials and energy and the surge in inflation risk penalizing performance and undermining the role of the Italian pharmaceutical sector, because they are burdening companies with costs that are difficult to sustain without an adequate increase in the final sale price.

This is what emerges from the fourth edition of thePermanent observatory on the generic drug system. The heart of this year's analysis was the measurement of the incremental impact that the prices of production factors and energy had on the cost structure of generic drug companies in the three-year period 2019-2021 and the expected change for 2022.

To present live stream the results of the study was Professor Lucio Poma, Chief Economist Nomisma, which was followed by a round table, moderated by Andrea Pancani, Deputy Director of TG La7, with representatives of the institutional world, the industrial panorama and operators in the healthcare world.

The following participated in the comparison: Joseph Busia, President of the National Anti-Corruption Authority – ANAC; Maurice Marchesini, Chairman of Marchesini Group SpA; Maurice Montemagno, Director General for industrial policy, innovation and SMEs - Ministry of Enterprise and Made in Italy; Antonella Garna, Director of the Pharmaceutical and Logistics Department – ESTAR Toscana; Adriano Leli, Intercent-ER General Manager – Emilia-Romagna; Walter Ricciardi, Full Professor of General and Applied Hygiene - Catholic University of the Sacred Heart; Luca Coletto, Councilor for health and social policies – Umbria Region; Armando Melon, Policy Officer – Representation of the European Commission in Italy; Beatrice Lorenzin, Member of the 5th Budget Commission - Senate of the Republic.

He closed the works Enrique Häusermann, President Egualia.

In this article, we review the main data emerging from the Observatory and the food for thought suggested by Nomisma to support companies in the pharmaceutical sector in this complex historical moment.

The Nomisma report on generic drugs

The report – edited by Lucio Poma, Maria Cristina Perrelli-Branca And Boris Popov – is divided into two sections. The first dedicated to the three continuous chapters of the Observatory and the second to the annual thematic focus. In detail:

- the first chapter of the report photographs the trend of the pharmaceutical sector in Italy;

- the second provides an assessment of the state of health of generic drug companies in economic and financial terms;

- The third is dedicated to the study of the market, with specifics on the local pharmaceutical channel, the hospital channel and the public tender system.

The Observatory concludes with a thematic focus, in this year's edition focused on a survey of generic drug companies aimed at describing the configuration of the cost structure of the companies to provide an estimate of the possible evolution in the light of the generalized increase of some components, including raw materials, energy and transport.

The trend of the pharmaceutical sector in Italy – Lucio Poma

As anticipated, the first chapter of the Nomisma study analyzes theperformance of the pharmaceutical sector, with reference to the dimensional structure of companies, the employment base, production and added value, investments made and export orientation. “The four main pieces of evidence concerning the short-term dynamics of the sector are the increase in employment, the stability of production in the face of a context of sharp decline, the excellent positioning of Italy at the international level and the confirmation of the propensity to investment” – he introduced Lucio Poma.

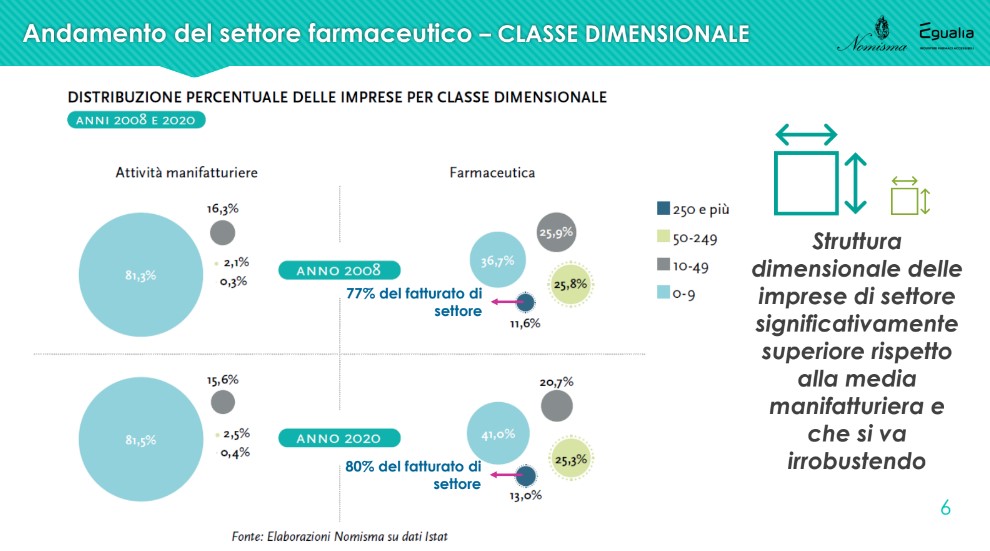

There dimensional structure of companies in the pharmaceutical sector is higher than the manufacturing average and is growing stronger: compared to 2008, there is an increase in companies with more than 250 employees (from 11.6% to 13%), with an incidence on the total sector turnover that grows from 77% to 80%.

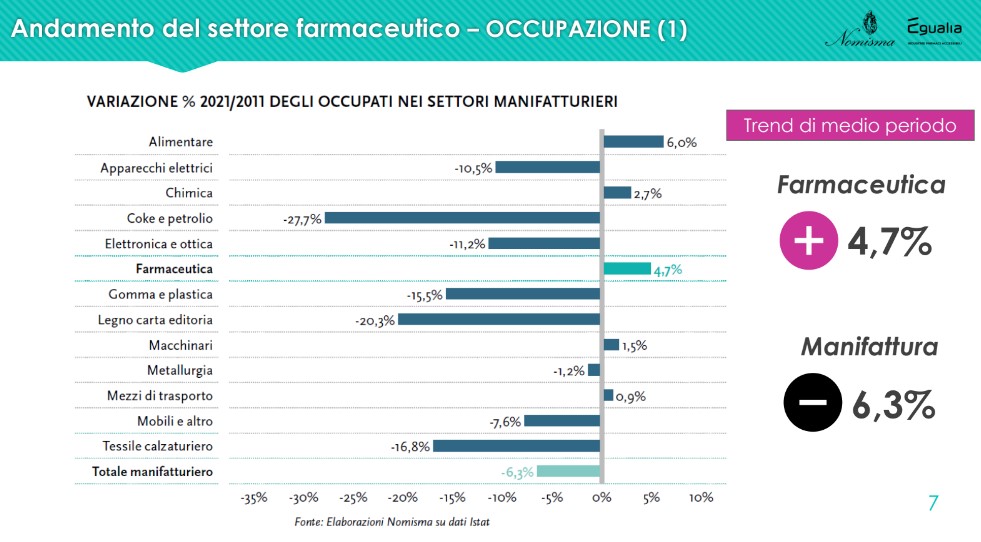

The data onoccupation of the sector is positive and shows a reality that, in constant expansion since 2014, employs over 67,000 people in 2021, up by 4.7% on 2011; a result in complete contrast with the negative one recorded by the manufacturing average (-6.3%). “Pharmaceuticals are a heritage of our country, not only from a health point of view, but also from an employment point of view. Above all, we are talking, for this sector, of mostly qualified, high-level employment" - commented Lucio Poma.

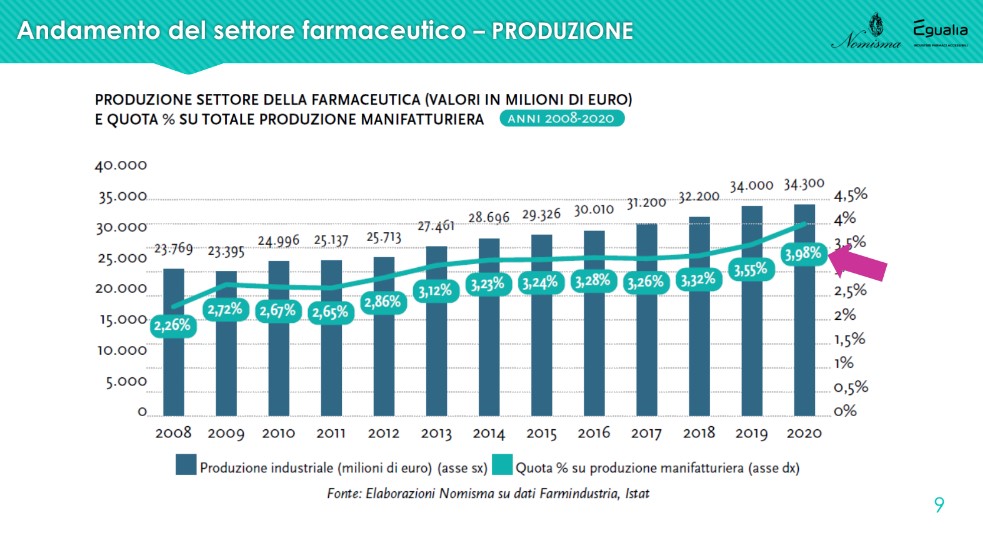

The share of the company is also growing steadily production linked to pharmaceuticals compared to the total of manufacturing, today at 3.98%, against 2.26% in 2008.

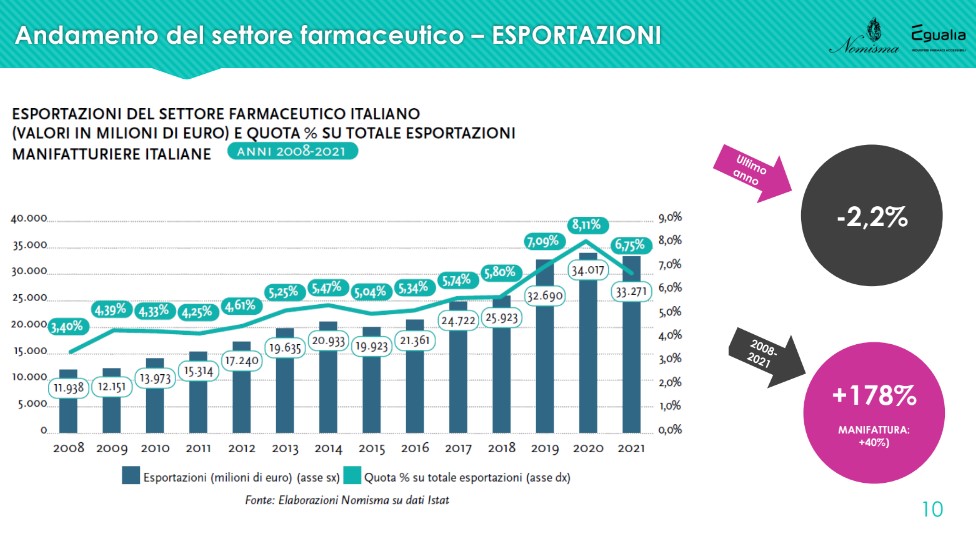

The exports recorded a slight decrease in 2021, a very particular year for all sectors. “But the values remain very high and confirm a positive trend: from 2008 to last year, the exports of the Italian pharmaceutical industry grew by +178% against the 40% of manufacturing. The sector therefore not only produces employment, but internationalizes its products”. The destinations change in part: exports to EU countries increase (+5 percentage points between 2020 and 2021), while those to North America decrease (-3 points). The balance is still positive: in 2021 exports recorded 33,271 million euros against 29,991 for imports.

The state of health of generic drug companies

The second chapter of the Observatory takes a snapshot of the state of health of the companies generic drugs. “Also in this segment we record a constant increase in employment, as well as positive results in terms of production value, a fair level of exposure to external sources of financing and an important generation of value in terms of impact on production and employment” – explained Lucio Poma.

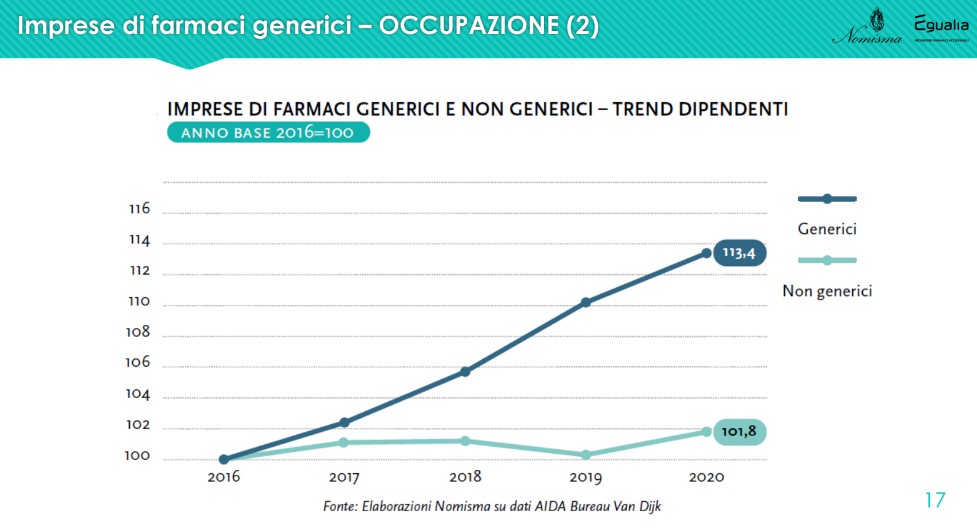

L'employment aspect it is significant because the comparison with non-generic drug companies shows a higher growth trend: 113.4% against 101.8% in the last 4 years. “From 2016 to 2020, employees increased by more than 1,100 units against an employment perimeter that remained stable among non-generic drug companies. If we then consider the role of the machinery used in companies, increasingly automatic and intelligent, this growth suggests how much that number is not only worth as a unit, but as the real value of human resources, in which generic drug companies have decided to invest even more so in a period of extreme uncertainty”.

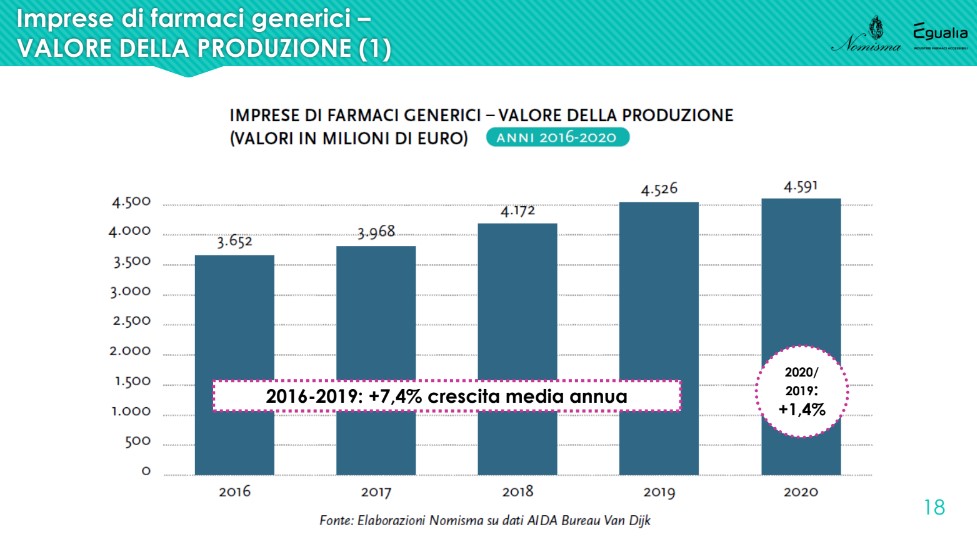

It also increases the manufacturing enterprises of generic drugs (average annual growth rate from 2016 to 2019 of +7.4%), at a decidedly higher rate than that of the non-generic component. However, "looking at the trend of the profits produced, while the former have an average incidence of 2-2.4% with respect to the turnover, the latter sail on levels around 10%, about 4 times as much. Despite the constant increase in the value of production, therefore, generic drug companies show margins that remain decidedly below those that characterize the world of non-generics”.

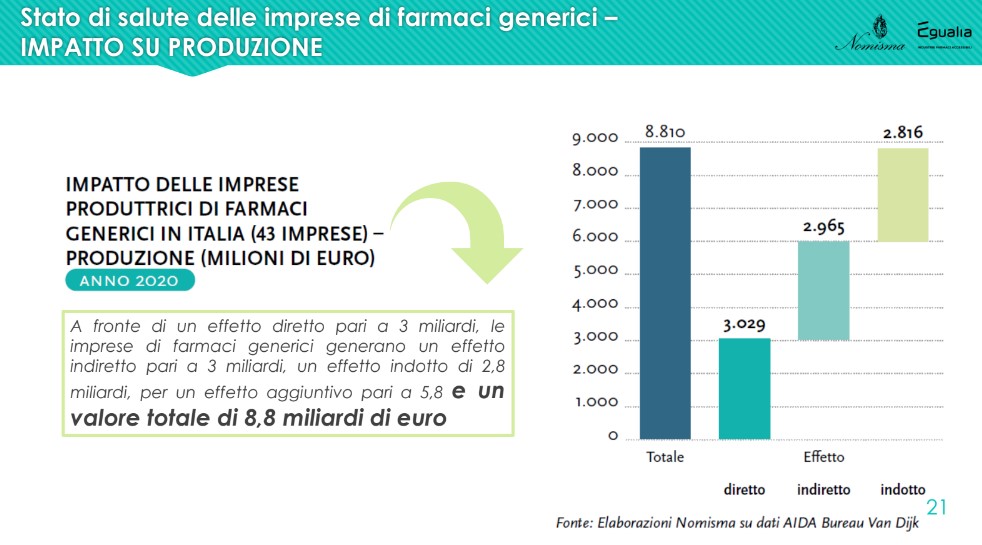

The analysis highlighted a further aspect, particularly relevant for the national economy as a whole, given by the impact radiated by the production of generic drugs companies on the operators of the entire supply chain: "Against a direct effect on production of 3 billion euros, an associated industry of 2.8 billion is generated, for an additional effect of 5.8 and therefore a total value of almost 9 billion euros. The same happens for employment: there are 9,784 employees directly employed by generic pharmaceutical companies, but a good 30,000 are employed in the supply chain and related industries, for a total of around 40,000 units” – recalled Lucio Poma.

The market: local pharmaceuticals and the hospital channel

The third chapter of the Observatory examines the market for generic drugs, with reference to local pharmaceutical and al hospital channel. “The survey highlighted a decrease in public territorial spending in favor of private spending and the advance of generics in the volumes of class A drugs to the detriment of those covered by patents. As far as hospital expenditure is concerned, the incidence of generics is growing more in volume than in value, while the risk of a reduction in competition in public tenders is increasingly increasing”.

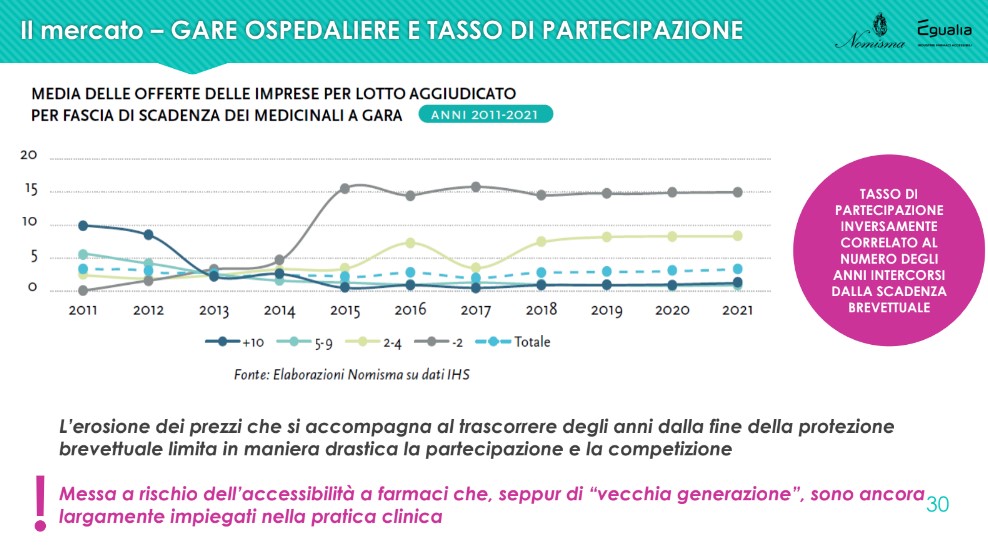

With particular reference to this last point, in relation to the specific off-patent segment (and, in particular, to the indicator that crosses the average number of bids per lot awarded with the patent expiry of the medicinal products subject to tender), what has been observed in 2021 it is confirmed as perfectly in line with what was observed starting from 2018: the firms' participation rate is inversely correlated to the number of years elapsed since the patent expired. In fact, companies compete in the years immediately following the expiry of the patent; the erosion of prices (and therefore the lowering of the level of profitability) which accompanies the passage of years from the end of patent protection drastically limits participation and competition, dangerously endangering the accessibility of drugs which, although of the "older generation", are still widely used in clinical practice.

From what has emerged, one can therefore draw a conclusion: “The advantage for the community of having affordable medicines must be defended, but not excessively. Because if, to protect this advantage, we put the sustainability of companies that produce generic drugs at risk, we have not done a good job. So we need to ask ourselves whether it is right to continue following the decreasing price trend or whether the time has come to think differently, because companies may not make it and it would be a lost asset for Italy”.

Focus 2022: the impact of rising prices on companies' production costs

After the three monitoring sections, the Observatory finally concentrates on developing an annual thematic focus. In 2022, the subject of in-depth study was theimpact of rising prices on firms' production costs.

The survey carried out by Nomisma involved, starting from March 2022, a sample of 21 companies associated with Egualia (the 75% in terms of turnover) who was asked to indicate the incidence and percentage increase of main cost items (active ingredients; excipients; packaging materials; energy sources; transport; labor costs) in the three-year period 2019-2021.

To contextualize the numbers from corporate sources, the extensive database provided by was then used Trading Economics which made it possible to detect the trend verified in the last three years by the four most used types of packaging material. Finally, to complete the picture of difficulty in which generic drug companies operate, the data has been integrated with numbers from the Global Supply Chain Pressure Index(GSCPI), the indicator that measures the global transport costs and the characteristics of the supply chains (PMI, Purchasing Managers' Index), based on variables such as delivery times, delivery backlogs and storage purchases.

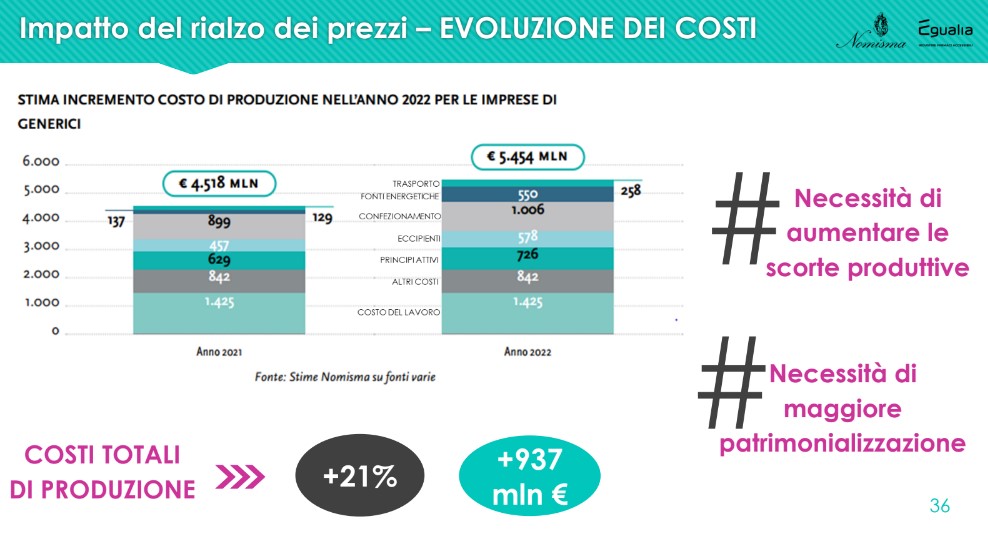

From the analysis data emerges a continuous price hike and transversal for all components, during the three-year period. The item for the use of energy sources, in particular, already starts to rise in 2021: for all items the overall increase in the three years is between 31% and 51%.

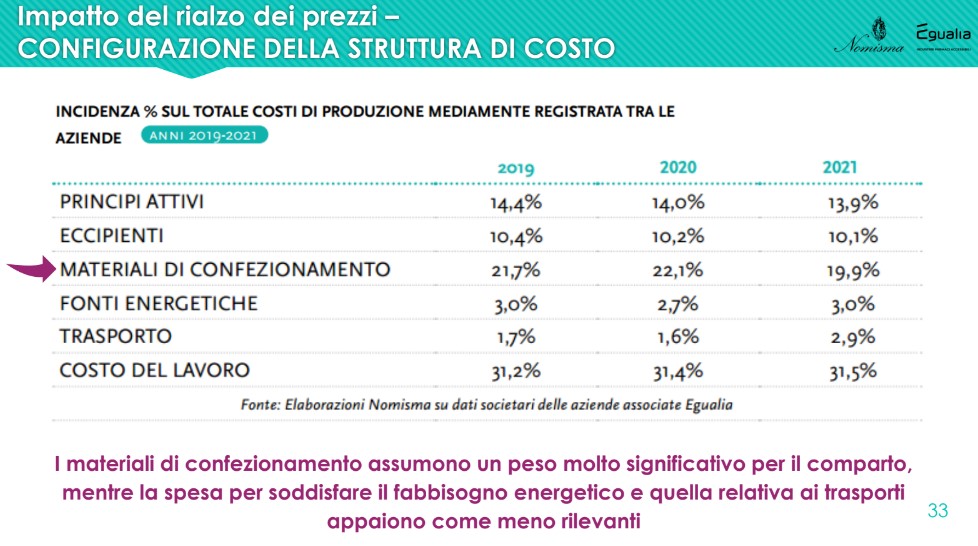

It is evident that i active principles (API) represent only a small portion of the costs necessary for placing a drug on the market: given 100 the production cost, the cost of the packaging materials, which in the three-year period recorded an incidence around 20%, while active ingredients and excipients respectively represent approximately 14% and 10% of the total.

Particular reference goes to all primary packaging materials (blisters, sachets, bottles, vials, tubes, etc.) and secondary – essential for guaranteeing the integrity of medicines – on which persistent price variations can cause great difficulties for companies that use them extensively, accounting for about a fifth of the total costs. Striking cases are the aluminum, which cost 37% more in the first half of 2022 than in the same period of 2021 (+60% compared to the first half of 2019); The polyethylene and the glass, grown by 9% in the same period.

The data also show how the logistical pressure worldwide started to take off at the end of 2020, with rapid and uninterrupted growth which - until the first quarter of 2022 - led to exceeding the levels recorded in the midst of the pandemic.

In anticipation, assuming output levels (drugs produced/marketed) and inputs (APIs, excipients, packaging material, energy, transport, labor costs, other operating costs) which, in quantitative terms, will remain unchanged in 2022 and considering only the price changes that these variables could undergo in the overall calculation for the year, we arrive at an estimate that sees an increase in total production costs of +21%, for a figure equal to approximately 937 million euro.

Doing business by managing uncertainty, Lucio Poma – Nomisma

The presentation of the Observatory therefore concluded with a series of observations to overcome what was defined by Lucio Poma 'The Season of Uncertainty'. “The drug supply chain is undergoing worldwide pressure, often unsustainable. All the transmutation taking place can be summed up in the term "uncertainty". Companies are forced – without having the tools – to switch from an organization based on risk management to a system based on the management of uncertainty. For this reason, support policies that help companies embark on a new organizational trajectory are indispensable”.

Among the possible paths to take:

Adjustment of the price calculation criteria

“The increase in raw materials needed for packaging, combined with expensive energy, has reached such high levels as to cast doubts, for some companies, on the convenience of production, to the detriment of chain stability and, potentially, the availability of final products" , continued Poma, stressing that the time has come "think on broader criteria in defining the prices of marketed drugs, since the cost of the active ingredients represents only a small portion of the costs necessary for placing a drug on the market and the 4-year timescale currently identified for the revision of the product price is not compatible with the sudden evolution of international markets”.

Support to the financial capacity of companies

“Discontinuity of supplies and volatility of prices of raw materials, energy and logistics select the ability of companies to resist on the market also on the basis of their liquidity and capitalization – explained Poma again -. To ensure a defensive strategy for companies, it would be necessary to make the production flow less rigid by simplifying some authorization regulations in the production sector”.

"Political" intervention of the State, between Pharma Strategy and Chips Act

“Strengthening the production chain and making the supply chain more stable and secure by limiting its interruptions is one of the pillars of the Pharmaceutical Strategy for Europe that the Commission communicated to the European Parliament on 25 November 2020, but the issue of supply chains it is such as to require levels of action above all at the national level”, underlined Poma, recalling that “the incentives made available in the last year for manufacturing companies in Italy are difficult to access due to some constraints relating to State Aid" and that "in Italy, unlike in other Member States, some incentives are intended exclusively for innovation, leaving aside large-scale production”.

The suggestion, then, is to draw inspiration from Chips Act, launched by the EU Commission in February and containing an important novelty on the Antitrust front, where the Commission itself suggests that competition policy can be "compatible" with state aid in the case of intense technological innovation but also in the case in which the need for a good is such that it falls "in the public interest".

“The Commission declares that chips are essential to guarantee almost all the production of European goods and services and that private investment in advanced structures would require significant public support, due to the high barriers to entry and the capital intensity of the sector. In the same way, the quality and safety of medicines are fundamental for citizens and require robust, well-functioning international supply chains, including through the strengthening of domestic production. Why the shortage of medicines on the national territory is the most serious risk we already run in the short term, in the absence of ad hoc interventions by institutions and regulatory agencies” – concluded Poma.

The permanent Observatory on generic drugs of Nomisma, an analysis process started in 2015

The fourth edition of thePermanent observatory on generic drugs in Italy di Nomisma is part of a punctual and rigorous market analysis process launched together with Egualia - Accessible Pharmaceutical Industries (formerly Assogenerici).

A path that, from 2015 to 2018, led to the publication of three reports: “The system of generic drugs in Italy. Scenarios for sustainable growth”, “The system of generic drugs in Italy. Hospital expenditure, effects of tenders and sustainability”, “The system of generic drugs in Italy. The manufacturing chain: competitiveness, impact and prospects”; and which, in 2019, gave life to thePermanent observatory on generic drugs in Italy, today an indispensable tool for monitoring and understanding the evolution of a key sector not only for the health of citizens, but also for the country's industrial system.

Related news: Biosimilars: IQVIA, 30 billion euros of cumulative savings to be reinvested in healthcare