UCB cotiza actualmente cerca de su máximo histórico tras un año de plusvalía del 30%

Friday, May 2, 2014

Since the past month of July the actions of the pharmaceutical company have revalued a 55%

The action of UCB currently costs at 59.2 euros, looking for the upper limit of its fluctuación rank of the last year, which at its time has been its maximum historical. Its evolution in this period has been eminently steep, accumulating in these twelve months a plus value of 30 per cent, while comparing with the minimum of the period (marked in July of the past year) its revaluation rises to 55 per cent. Analyzing a broader period of time observed as this value is being dibujando an alcist line from the media of 2009, having more than duplicated its value in the bag in this period.

The last results published by this pharmaceutical group correspond to the first quarter of the current year. Inputs have risen to 840 million euros with an inter-annual increase of 5 per cent (9 per cent deducted from the negative impact of the exchange rate). Detach in this period the good behavior of medicines such as Cimzia, Vimpat and Neupro (for the treatment, among other pathologies, of rheumatoid arthritis, epilepsia and Parkinson's disease respectively), with joint ventures of 318 million euros and an increase interannual of 29 per cent, allowing her more than to compensate for the fall of the vents of one of her star pharmaceuticals, the antiepileptic Keppra, which withdraws a 2 per cent.

Also can be highlighted the dynamism shown by the emerging markets with a growth (with type of constant change) of 11 per cent. However, the negative impact of the uniforms results in a negative final variation of 1 percent. Asimismo, another market with a destacado behavior was the japonés.

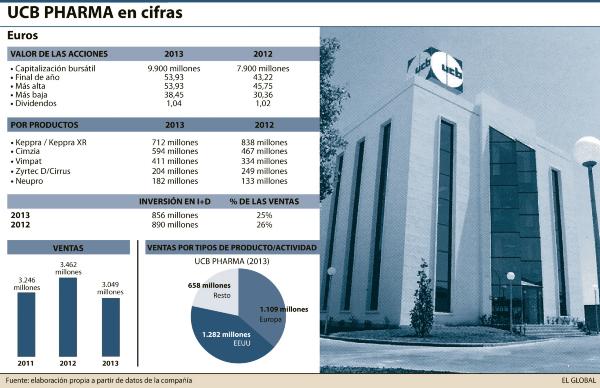

In this sentiment, the past year the inputs from UCB ascended to 3,400 million euros, a 1 per cent less than in the previous year (2 per cent purified by the effect of the type of exchange). On the other hand, the net benefit was 200 million euros, with an interannual descent of 18 per cent (3 per cent without the impact of the type of exchange).

Likewise, among the presentation of the results that the company has obtained, UCB confirmed its estimate for the current exercise, with expected sales that could exceed 3,500 million euros. In this sentiment, the Ebitda (beneficios antes de intereses, amortizations and taxes) could raise the 770 million euros.

As he recently pointed out, he reported that UCB has signed an agreement with Biogen for exclusive marketing on various markets in Southeast Asia. Thus, the drugs that are affected by this operation are those intended for the treatment of multiple sclerosis and hemophilia.

On the other hand, and in relation to his possible behavior in the bag in the short and medium-sized market, indicate that his current trend is clearly alcist, it is good to actually buy him at comparatively very high levels in relation to his historical references could limit his potential suffered in the next few months, because it will have to follow its evolution.

UCB is currently near its all-time high following a one-year appreciation of the 30%

Friday May 2, 2014 El Global.net

Since last July, the pharmaceutical company's shares have risen by 55%

UCB's share is currently trading at €59.2, towards the upper end of its trading range from last year, which itself was a record. Its evolution in this period has been eminently bullish, accumulating a gain of 30 per cent in the last twelve months, while the comparison with the minimum period (indicated in July of last year) the revaluation is equal to 55 per cent. Looking at a longer period of time, we see that this value is seen as an index of an upward line since mid-2009, having more than doubled its market value in this period.

The latest results published by the pharmaceutical group correspond to the first quarter of this year. Revenues amounted to €840,000,000, with an increase of 5 percent (9 percent adjusted for the negative impact of the exchange rate). Highlights in this period the good performance of drugs such as Cimzia, Vimpat and Neupro (for the treatment, among other diseases, rheumatoid arthritis, epilepsy and Parkinson's, respectively), with combined sales of € 318 million and annual growth of 29 percent, making it possible to offset the drop in sales of one of its "star" drugs, the antiepileptic Keppra, which falls by 2 percent.

Also noteworthy is the dynamism in emerging markets with growth (at constant exchange rates) of 11 per cent. Despite the negative impact of foreign currency accounts for a final negative 1 percent change. Also, another outstanding performing market was the Japanese.

In this regard, UCB's revenues last year amounted to 3,400 million, up 1 percent on the previous year (2 percent the effect adjusted for the exchange rate). Meanwhile, net income was 200 million euros, a decrease of 18 percent (3 percent excluding the exchange rate impact).

Furthermore, following the presentation of the results they have rendered to the company, UCB has confirmed its estimate for the current year, with expected sales that could exceed 3,500 million euros. In this sense, EBITDA (earnings before interest, depreciation and taxes) could reach €770 million.

A real recent and noteworthy highlight is that UCB has signed an agreement with Biogen for exclusive commercialization in several Southeast Asian markets. Therefore, the drugs that are involved in this operation are those for the treatment of multiple sclerosis and hemophilia.

Furthermore, in relation to their possible behavior in the stock market in the short to medium term, indicates that its current trend is clearly upwards, while it is currently trading at relatively high levels compared to their historical benchmarks could limit its potential increase in the coming months, so I know he will have to continue to follow his evolution.