It would be useful for Farmindustria, AIFA, the General Directorate of Labor and Economic Development, the press and the trade unions to know what happens on the labor "market".

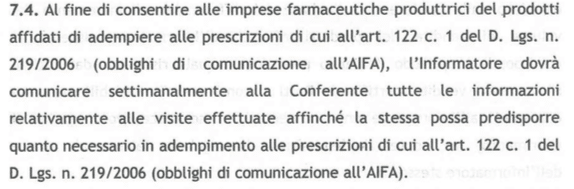

We have come to know of a "consultant contract ISF which specifies that the informant must carry out the work completely independently. But, says the contract, to comply with the obligations of Legislative Decree 219/06 and the requests of AIFA, he must send the weekly program and the doctors visited. Assay unloading: required ONLY for ethical products. The law article quoted says “In January of each year, each pharmaceutical company must communicate to AIFA, on a regional basis, the number of healthcare professionals visited by their scientific representatives in the previous year, specifying the average number of visits carried out“. That is, the law does not ask for a weekly report or the names of the doctors visited.

We have come to know of a "consultant contract ISF which specifies that the informant must carry out the work completely independently. But, says the contract, to comply with the obligations of Legislative Decree 219/06 and the requests of AIFA, he must send the weekly program and the doctors visited. Assay unloading: required ONLY for ethical products. The law article quoted says “In January of each year, each pharmaceutical company must communicate to AIFA, on a regional basis, the number of healthcare professionals visited by their scientific representatives in the previous year, specifying the average number of visits carried out“. That is, the law does not ask for a weekly report or the names of the doctors visited.

It would be interesting to know AIFA's thoughts on the matter: the reporting of the doctors visited becomes a control tool, incompatible with the contractual essence and spirit repeatedly specified and reaffirmed, by way of clarification.

It would be interesting to know AIFA's thoughts on the matter: the reporting of the doctors visited becomes a control tool, incompatible with the contractual essence and spirit repeatedly specified and reaffirmed, by way of clarification.

Payment of percentages on the “INCREASES (or differential) compared to the previous year.

Since without assistance the turnover would physiologically disappear, it would be useful to know how much the recovery of the loss is valued  physiological first step in vision of future developments codified by the contract.

physiological first step in vision of future developments codified by the contract.

In the event of illness, the payment of fees is suspended: from the first day.

Therefore, the performance of the informant is not taken into account. Turnover historically tends to decrease, but not with the immediacy that they intend to believe.

Fixed salary: €200/month gross. This will be the only payment up to the important development of turnover.

A development for which it will take at least 4/5 information cycles.

A development for which it will take at least 4/5 information cycles.

Considering the limitations expressed by the doctors, it will take more or less a year / year and a half to start seeing a development in turnover.

Where we consider that the only "expenses" (INPS-CAR DEPRECIATION-FUEL-ACCOUNTANT-PARKING-CHAMBER OF COMMERCE-etc.) amount to 1000/1500 euros per month, that contract provides for a personal outlay that can be estimated at at least 10 thousand euros in algebraic sum with the skills.

In Italy, theart. 36 of the Constitution stipulates that the salary must be "proportionate" to the work performed, and in any case "sufficient" to guarantee a dignified life for the worker and his family. These levels have traditionally been identified by jurisprudence in the minimums set by the corresponding national employment contracts.

In Italy then the problem of contract evasion is real and particularly painful in some sectors among which the fake-autonomous, as in this case, constitute a consistent part. Unfortunately, the inspection tools are culpably insufficient, as revealed by the high level of regulatory avoidance in various other areas of national life.

And that it is a fake self-employment, despite the contractual tricks, it is clear and any court will not hesitate to recognize it.

The self-employment "pure“, often framed with the locution “VAT registered work“, manifests itself in the following forms:

- Work contract (articles 2222 and following of the civil code);

- Intellectual work contract (articles 2230 and following of the civil code).

Fundamental characteristic is the absolute operational and organizational autonomy. In fact, the self-employed person decides independently the times, methods and means necessary for the execution of the service, is not subject to the managerial, organizational, disciplinary and control power of the client and operates without any coordination with the client's activity same.

Fundamental characteristic is the absolute operational and organizational autonomy. In fact, the self-employed person decides independently the times, methods and means necessary for the execution of the service, is not subject to the managerial, organizational, disciplinary and control power of the client and operates without any coordination with the client's activity same.

Nowadays, in fact, there are many employers who induce their employees to resort to the opening of the VAT number (precisely "false"), for the sole purpose of avoiding being trapped in employment contracts which are obviously more burdensome and inconvenient.

The worker is the only injured party in the employment relationship as he does not enjoy welfare or social security protections that are normally due to employees or rights recognized to workers.

Considering the damage caused by the flexibility and precariousness of work, workers are therefore willing to be paid as little as possible in order to be hired and are forced to compete on wages. The phenomenon is also facilitated by high levels of unemployment which induces many young people to accept "sacrificing" jobs.

With the Jobs Act, however, they must be considered as subordinate work "exclusively personal work performance, continuous, repetitive, and organized by the client with respect to the place and working hours”. Also starting from 1 January 2019 Holders of a VAT number who carry out activities mainly for one of the employers of the previous two years or, in any case, for customers directly or indirectly attributable to them, will not be able to join the flat-rate regime. There is also a bill which dictates a rule of authentic interpretation of thearticle 2094 of the Civil Code, "employee provider" in which he is considered an employee: "... whether the result of the service is destined to the employer and whether the organization to which the service is intended is not one's own but the employer's". The bill also proposes theminimum wage requirement for all employment relationships, even for atypical ones, which is not lower than the provisions of the national collective bargaining agreements for the category.

It should be noted that self-employment for the ISF is completely legitimate.

Legislative Decree 219/06 excludes the remuneration of the self-employed ISF parameterized to sales data, least of all to those obtained from statistical indications, even if accurate, as ruled by the Cassation and various courts (utopia?).

The self-employed ISF, in this case, has a professional mandate for the performance of consultancy activities and as such must be paid with an appropriate consideration precisely for the consultancy it provides, otherwise what consultancy it is. That of the ISF consultant, not being able to sell or have commissions on the sales, is a typical obligation of means in which, unlike an obligation of result, the ISF professional undertakes to carry out a specific activity without however being obliged to guarantee the customer the "expected result", and failure to achieve this does not imply a breach.

Finally, the contract refers to the Legislative Decree 231/2001 on the liability of the company, in the sense that if the unfortunate consultant ISF were forced to engage in any illicit behavior, the legal responsibility lies solely and exclusively with the ISF. By signing that contract, the consultant ISF acknowledges that the company "does not respond if the persons indicated [ed: company representatives] acted in their own exclusive interest or that of third parties”. And being autonomous, any responsibilities are his alone.

Beyond the legal aspects, the shame that such contracts represent not only for workers but for human dignity itself remains. There is no end to shame in our country.