Electronic invoicing for flat rates, how to manage it? The guide for the inexperienced

From this 1or July 2022 a substantial change will take place for all those who have a VAT number. This measure is specifically aimed at those adhering to the flat-rate regime, i.e. intended for those economic operators of small dimensions who have had revenues not exceeding 65,000 euros. As you can read on the official portal of the Revenue Agency, the flat-rate scheme provides for significant simplifications for VAT and accounting purposes, and also allows for the flat-rate determination of the income to be subjected to a single tax to replace those ordinarily envisaged, as well as access to an optional contributory scheme for businesses. However, what will happen in a few days will be the obligation for the aforementioned VAT holders to use electronic invoicing. Let's go down, then, in detail to better clarify the matter.

From this 1or July 2022 a substantial change will take place for all those who have a VAT number. This measure is specifically aimed at those adhering to the flat-rate regime, i.e. intended for those economic operators of small dimensions who have had revenues not exceeding 65,000 euros. As you can read on the official portal of the Revenue Agency, the flat-rate scheme provides for significant simplifications for VAT and accounting purposes, and also allows for the flat-rate determination of the income to be subjected to a single tax to replace those ordinarily envisaged, as well as access to an optional contributory scheme for businesses. However, what will happen in a few days will be the obligation for the aforementioned VAT holders to use electronic invoicing. Let's go down, then, in detail to better clarify the matter.

Until this June 30th, in fact, it will be possible to issue an invoice also using the classic method or by sending the PDF of the latter but, indeed, for a little while longer. Always referring to the official communication of the EA, the substantial difference between the electronic invoice and the traditional one is really very little. Indeed, the first must necessarily be drawn up using a PC, tablet or smartphone and must be transmitted electronically to the customer via the so-called Exchange System (SdI). In the event of a positive outcome of the checks, the Exchange System safely delivers the invoice to the recipient  by communicating, with a "delivery receipt", the date and time of delivery of the document to whoever sent the invoice. Ultimately, therefore, i mandatory data to be reported in the electronic invoice are the same as those reported in the paper invoices in addition to the telematic address where the customer wants the invoice to be delivered.

by communicating, with a "delivery receipt", the date and time of delivery of the document to whoever sent the invoice. Ultimately, therefore, i mandatory data to be reported in the electronic invoice are the same as those reported in the paper invoices in addition to the telematic address where the customer wants the invoice to be delivered.

However, there is the possibility of not adapting to the electronic system until 2024, but only for VAT numbers with revenues of less than 25,000 euros. In fact, the latter will be able to continue with "traditional" billing until 31 December 2023 but, later, they too will have to adapt to electronic invoicing as will happen, we reiterate, for all adherents to the flat-rate regime by and no later than 1 July 2022.

Hoping, then, that with this method of tracking invoices tax evasion can significantly decrease, we hope that technological problems will not occur too frequently. Remember then, VAT numbers, adjust your billing as soon as possible to the electronic system, July 1st is really upon us.

Related news: Revenue Agency. Electronic invoice and telematic payments

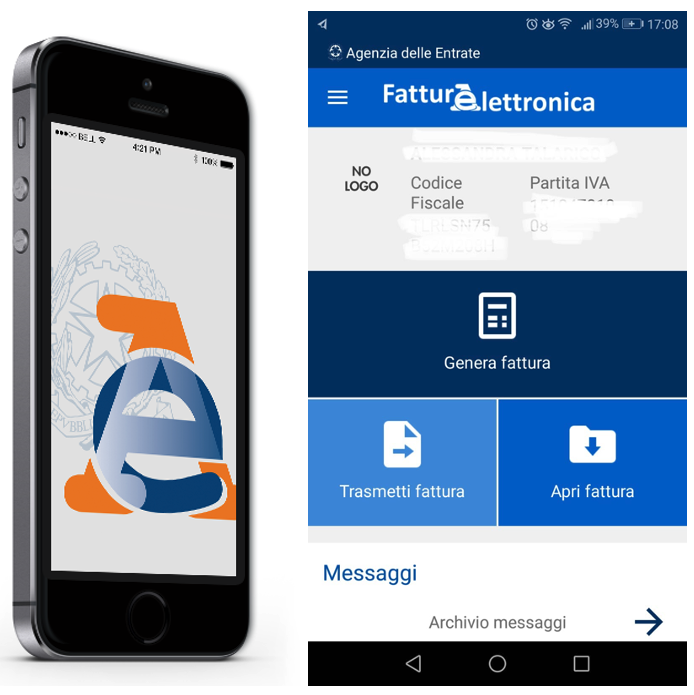

The Revenue Agency's Fatturae App for free electronic invoices: the guide

Flat-rate regime: it is convenient but it must be handled with care..