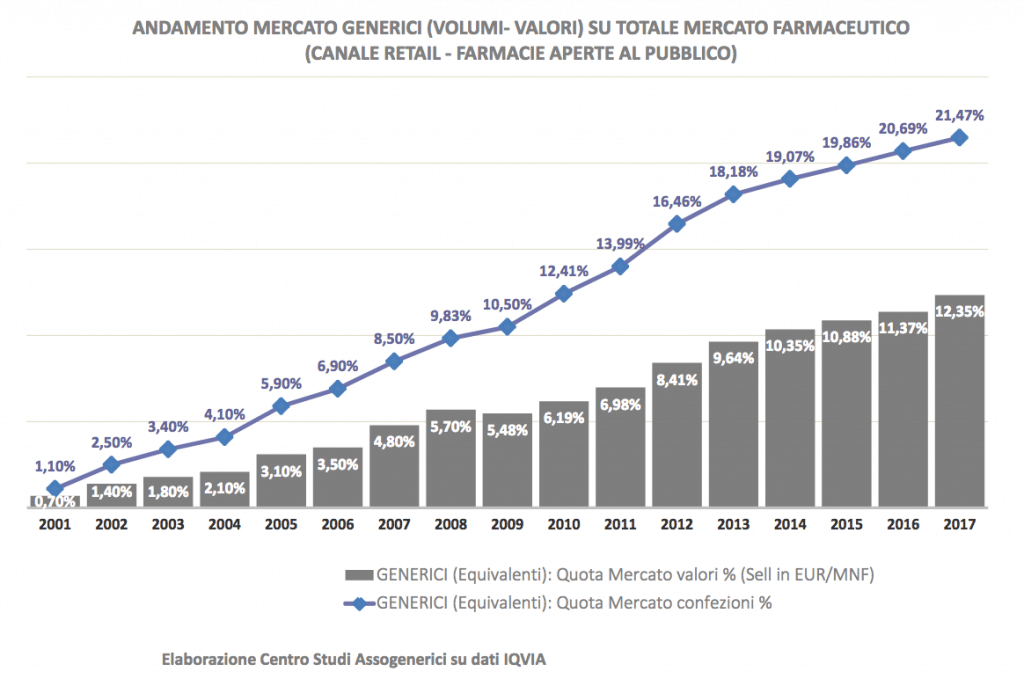

Another year of growth for the generic medicines market which in 2017 absorbed 21.5% in packs and 12.4% in values from the pharmacy channel. Almost 90% of generic drug packages are class A, fully reimbursed by the National Health Service. The data is contained in the annual report of the Centro Sudi Assogenerici which gives an account of the final data from January to December 2017.

The analysis of trends in the pharmacy channel highlights a positive performance of equivalent products (classes A and C) with growth of 5.7% in units and 9.5% in values, against a decline in the overall pharmaceutical market (-1% per unit and -1.6% in values) and an even wider slowdown in the market for branded products with expired patents (-2.8% in units and -3.1% in value).

The segmentation of the overall market by volume (all classes) thus records an incidence of 54.11% of branded drugs with expired patents and the division of the remaining share for 24.42% to drugs covered by patent and 21.47% to equivalents. Expired patent brands also dominate the segmentation of the value market (all classes) absorbing 49.13%, followed by patent-protected drugs (38.52%) and by a considerable distance the equivalents (12.35%).

In the pharmacy channel (all classes), the market segmentation of only off patent products still sees a clear predominance of expired patent brands which absorb 72% in packs and 80% in values, against 28% in packs and 20% in values of the equivalents.

SSN consumption is down, three-speed regional markets

The analysis of consumption in pharmacies documents a general contraction in the class A market reimbursed by the NHS for 2017, with a drop of 1.1% in reimbursed packs and 1.8% in reimbursed expenses compared to 2016. In particular, the expenditure relating to products still covered by patents decreased by 9.5% and the expenditure for equivalents increased with +5% compared to the previous year.

The analysis of consumption by geographical area instead confirms the traditional polarization of consumption with a North characterized by a robust recourse to equivalent care (35.4% in units and 24.8% in values), compared to a decidedly lower Italy average (28 .5% in units and 20.1% in values) and even lower consumption in the Center (26% in units; 18.6% in values) and in the South (20.9% in units and 14.8% in values). From this point of view, the best performance of the Autonomous Province of Trento is confirmed, where 80.9% of the units dispensed by the NHS in class A is off patent and the generic absorbs 41.8% of the total. Followed by Lombardy (78.5% and 37.8%), Emilia Romagna (81.2% and 35.3%), the Autonomous Province of Bolzano (78.7% and 34.1%). At the opposite extreme, Basilicata is bringing up the rear, with an off patent incidence of 78.9% on the total reimbursed NHS, but with a share of equivalents of 19%.

Finally, the portion paid as the price differential by citizens to collect the brand instead of the equivalent amounts to 1,082 million euro: the highest incidence at the regional level is recorded in Sicily (14.5% for a total of 111 million) and in Lazio ( 14.2% equal to 136 million euros). The lowest incidence is instead recorded in Lombardy, where the difference paid out of pocket by citizens accounts for 10.7% of regional NHS spending in the retail channel.

Therapeutic areas and active ingredients

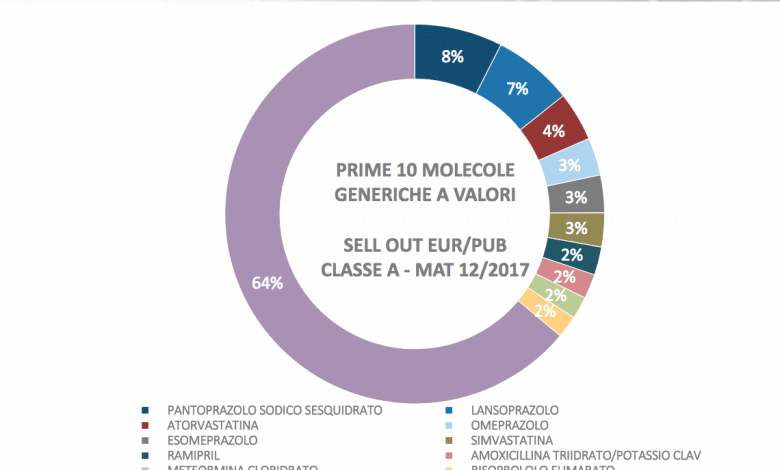

Among the drugs reimbursed by the NHS, the therapeutic areas in which the greatest diffusion of equivalents is recorded is that of ACE inhibitors (46.2% per unit) and that of proton pump inhibitors (50.9% per unit). In fact, among the molecules with the highest incidence of use of equivalent drugs we find pantoprazole, lansoprazole and ramipril.

As far as class C is concerned, at the sole expense of the citizen, the main therapeutic areas with the greatest diffusion of generic drugs are confirmed as tranquilizers (37.2% Units) and products for erectile dysfunction (37.9%). Among the molecules with the highest incidence of use of equivalent drugs are lorazepam and sildenafil.

Hospital channel

Lastly, in the hospital channel, in 2017 equivalent products absorbed 25.4% of the volume market and 6% of the value market, a decidedly limited performance against the absolute predominance of exclusive products, holders of 39.1% of volumes and of 87.3% of the sector's turnover, against the 6 % in values absorbed by the equivalents.