VAT numbers. New flat-rate regime of up to 85,000 euros but with an anti-avoidance clause

Two important innovations arriving for VAT-registered taxpayers in the flat-rate regime: revenue limit of 85,000 euros from 2023 and anti-avoidance clause for those exceeding the limit itself

Tax information - November 24, 2022 by Anna Maria D'Andrea

The new flat-rate regime will see two important changes from 2023: revenue limits that will go from 65,000 to 85,000 euros and an anti-avoidance clause from 100,000 euros. But these are still speculations.

The new flat-rate regime will see two important changes from 2023: revenue limits that will go from 65,000 to 85,000 euros and an anti-avoidance clause from 100,000 euros. But these are still speculations.

In fact, the final approval of the Parliament must arrive on the text by the end of the year.

In the meantime, however, the framework of measures for next year.

The premier Giorgia Meloni talked about the introduction of three flat taxes from 2023 and this change to the access threshold to the scheme is one of them.

The other two flat taxation formulas mentioned by Meloni consist inintroduction of an incremental flat tax to the 15 percent with a deductible of 5 per cent and a maximum ceiling of 40,000 euros and in the enhancement of detaxation of productivity bonuses.

VAT numbers, flat-rate scheme up to 85,000 euros in 2023: the news on the flat tax

In view of the development of the Budget Law 2023 there flat tax back to the center of attention.

There flat tax of 15 percent has always been one of the workhorses of the Center Right and the Meloni Government, with Minister Giorgetti as head of the Economy, could take new steps for the implementation of the ambitious and controversial project to overcome theIRPEF.

The innovations on the flat tax included in the 2023 Budget Bill arise from the need to act taking into account two particularly "strict" issues: that of the possible unconstitutionality of the flat tax and that of necessary resources.

Precisely for this reason we also start from the flat taxes already in force and in particular we act on the flat rate scheme.

The access and permanence threshold that today is set at 65,000 euros, according to the current structure of the next Maneuver, it should rise to 85,000 euros.

Anti-avoidance clause of 100,000 euros

The second novelty that can be read in the draft of the 2023 Budget Law is related to rules for exiting the regime.

In fact, the rule that Parliament will have to discuss and possibly approve provides that:

The flat-rate regime ceases to apply from the same year in which the revenues or fees are received are more than 100,000 euros.

In the latter case, the value added tax is due starting from the operations carried out which lead to the exceeding of the aforesaid limit

This involves passing a absolutely paradoxical situation such as the current one in which, incredibly, the taxpayer in the flat-rate regime could exceed the revenue limit indefinitely in the tax period in question, pay taxes using the 5% or 15% and exit the regime only the following year, "escaping ” in the year in which the limit was greatly exceeded.

This involves passing a absolutely paradoxical situation such as the current one in which, incredibly, the taxpayer in the flat-rate regime could exceed the revenue limit indefinitely in the tax period in question, pay taxes using the 5% or 15% and exit the regime only the following year, "escaping ” in the year in which the limit was greatly exceeded.

In this way, however, it is guaranteed that in the event of exceeding the limit below 100,000, the taxpayer does not have to pass out by taking everything back to taxation with IRPEF and VAT, but simply coming out the following year.

An anti-avoidance rule that could potentially produce greater tax justice in the coming years.

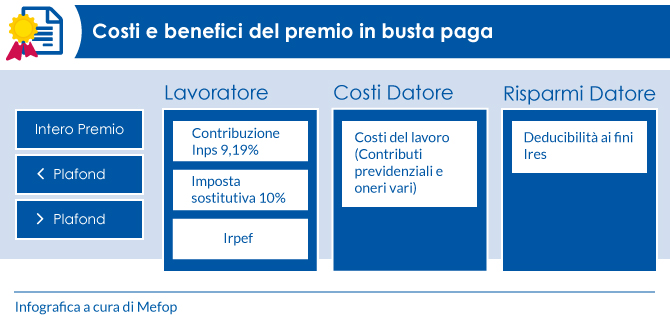

The performance bonus (also called production bonus) is the additional share to the salary that is paid to employees upon achievement of increases in productivity, profitability, quality, efficiency and innovation. The worker can choose whether to receive it in a paycheck. In this case, he can opt for a preferential taxation of the 10% as long as the premium does not exceed €3,000 gross per year. And the previous year's employee income does not exceed €80,000. For the company however, the cost is linked to social security contributions and other types of charges, even if it is deductible for IRES purposes. To take advantage of these concessions, there must be a territorial or 2⁰ level agreement with the union parties which expressly provides for the possibility of using them for all workers.

In the list of measures inserted in the press release dated November 21, 2022 it is read:

"Tax-free productivity bonuses - For employees, a rate of 5% for productivity bonuses up to €3,000".

The novelty was also confirmed in Press conference by Prime Minister Giorgia Meloni who cited her as  one of three incoming flat fees, together with the extension of the flat rate to 85,000 euros and the incremental flat tax.

one of three incoming flat fees, together with the extension of the flat rate to 85,000 euros and the incremental flat tax.

To understand the scope and nature of the novelty on employee bonuses, however, it is worth analyzing the current rules on which it is intended to intervene.

Subject to modifications, probably temporary, should be thearticle 1, paragraphs from 182 to 189, of the 2016 Stability Law.

The law currently in force provides for theapplication of a substitute tax of 10 per cent to the "performance bonuses of variable amounts, the payment of which is linked to measurable and verifiable increases in productivity, profitability, quality, efficiency and innovation" based on specific criteria.

According to the statement, therefore, therate should drop to 5 percent: the novelty, in other words, consists in the strengthening of the tax relief. The conditional remains mandatory because the text of the Budget Bill is still missing and the parliamentary discussion that will lead to the final decisions has not yet begun.

Employee bonuses: how the tax relief that the Government calls flat tax works

It should be emphasized, however, that it is possible to apply thesubstitutive tax to the employee bonuses up to €3,000 under specific conditions.

In addition to being disbursed in the presence of "measurable and verifiable increases in productivity, profitability, quality, efficiency and innovation" the tax-free premiums can be recognized ai holders of income from employment of an amount not exceeding, in the previous year, a 80,000 euros.

But there is also a rule that prescinds from the individual or the single worker: i employee bonuses can be detaxed only if the sums are disbursed in execution of corporate or territorial agreements stipulated by comparatively more representative trade union associations, by company trade union representatives or by the  unitary trade union representation. Contracts also need to be filed together with the declaration of conformity.

unitary trade union representation. Contracts also need to be filed together with the declaration of conformity.

This condition greatly restricts the range of action of the relief on productivity bonuses since it can be difficult for small and medium-sized enterprises to activate the union procedures necessary due to the costs to bear, too high in relation to the benefits that would derive from it.

The data contained in the report drawn up by the Ministry of Labour last November 15 give an idea of what the scope of the news coming with the 2023 Budget Law: the deposited and currently active contracts are 13.038.

The measure, as announced, undoubtedly creates gods benefits for male and female employees, but it cannot be said that it is one flat tax universally addressed to the category.

Without a doubt it is too early to draw conclusions, but to enhance the detaxation of performance bonuses you should act on the whole system of rules and not just on one rate reduction, which only facilitates those who already have what it takes to obtain the benefits.

Or even to reach a larger number of male and female workers, attention should be shifted to other measures, such as the tax exemption provided for i fringe benefits that the Aid Decree quater has extended for amounts up to 3,000 euros, but only for 2022 and only for certain types of reimbursement.

Source Tax information

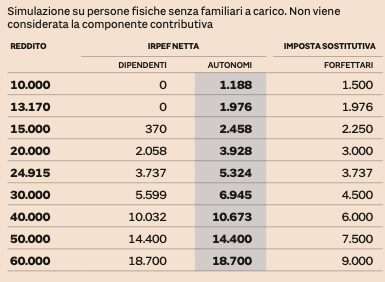

The raising of the limit of annual revenues/fees from 65,000 to 85,000 euros will concern a minimal part of Irpef taxpayers (when fully operational it should have a financial impact of less than 400 million per year) and will be chosen only by subjects with "light" structures, characterized by low costs and low propensity to invest. Appreciable, and in line with EU directive 2020/285, is the choice to end the flat-rate scheme from the same year in which the revenues/fees exceed the amount of 100 thousand euros.

The raising of the limit of annual revenues/fees from 65,000 to 85,000 euros will concern a minimal part of Irpef taxpayers (when fully operational it should have a financial impact of less than 400 million per year) and will be chosen only by subjects with "light" structures, characterized by low costs and low propensity to invest. Appreciable, and in line with EU directive 2020/285, is the choice to end the flat-rate scheme from the same year in which the revenues/fees exceed the amount of 100 thousand euros.

(source il Sole 24ORE of 27.11.2022)