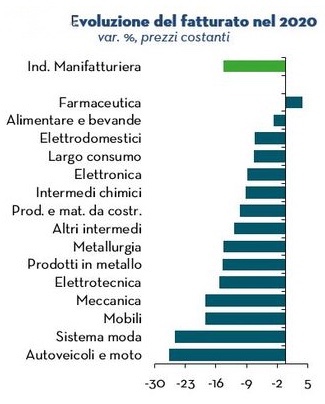

- The countertrend of the trend is confirmed Pharmaceutical (+3.9%), thanks to the excellent positioning in the global value chain which allows it to seize the opportunities of a driving global demand. Moderate decline Food and drinks, Large consumption, Home appliances, Electronics And Building products and materials. More struggling Mechanics, fashion systemand supply chain automotive.

Difficulties spread to all sectors, with the exception of Pharmaceuticals

We confirm growth estimates for Pharmaceuticals (+3.9% at constant prices in 2020), the only exception in the sector picture, thanks to a driving world demand, against a slightly falling domestic demand for medicines (summary of an increase in demand for Covid treatments and a decline in other therapies), and expectations for food and beverage revenues to hold (-2.8%), thanks to weak export growth and the increase in domestic food consumption, which partly offset the decline  generalized distribution of the Ho.Re.Ca. channel

generalized distribution of the Ho.Re.Ca. channel

Following in the ranking, with a drop in turnover around the 7% at constant prices, are FMCG (supported by the vivacity of demand for hygiene products, which does not compensate for the drop in cosmetics) and household appliances (which are benefiting from a recovery in orders from foreign markets and an internal demand supported by the driver of housing redevelopment, in a context in which the domestic environment is more experienced and also used for work purposes). For Electronics, both consumption of domestic technology and investments in digitization contribute to containing the fall in turnover in 2020 (-8.9% at constant prices).

Among the sectors that are expected to contract less than the manufacturing average, we find construction products and materials (-10.5% the expected drop in 2020, again at constant prices), whose turnover is benefiting from the restart of investments in construction, in particular of residential redevelopments (for which ecological and anti-seismic incentives were strengthened), Other Intermediates (-11.8%), supported by the increase in demand for plastic and paper products linked to the health emergency and Chemical Intermediates (- 9.2%), thanks to the demand for chemicals for sanitizing products which is driving exports.

Performance in line with the average manufacturing trend for Metallurgy and Metal Products (with expected turnover down by 14.3% and 14.5% respectively, at constant prices), whose activity is positively affected by construction but negatively by Mechanics and automotive supply chain.

The economic difficulties of the automotive sector are also penalizing the Electrical engineering sector, which opens the lower part of the sector ranking (-15.2% the expected drop in turnover at constant 2020 prices), despite the driving force offered by growing investments in an ecological key, both in the sector cars and in construction. Even more penalized was Mechanical Engineering (-18.4% the expected contraction on average for the year), which is facing a marked decline in world demand (above 13% in 2020, according to our estimates, against approximately -10% for the total manufacturing) and a setback in investment on the domestic front.

The redevelopment of the domestic environment linked to smart working is driving the recovery of the Furniture sector, which after a very intense fall in the lockdown phase, should be able to contain the drop in turnover at constant 2020 prices to 18.5%.

At the bottom of the ranking are the fashion system (-25.4% the expected drop for 2020) and motor vehicles and motorcycles (-26.8%). A season substantially lost due to the restrictive measures on mobility undertaken in the spring at an international level, and a year end characterized by a climate of uncertainty, with limitations on social life that will further curb the consumption of these goods, weigh on the performance of fashion . The automotive sector suffers from the effects of the severe economic crisis which led to a postponement of the demand for motor vehicles, even if the expectations are for a partial recovery of the sector's turnover between August and December, thanks to the boost of the eco-incentives for cars approved in the August Decree, which have already reported positive registration numbers in September.