Italy is the country of VAT numbers

Blue Suitcase – February 15, 2023 by Mattia Marasti

The labor market in Italy, as reiterated and underlined several times, is in a worrying state. Negative wage growth over the last thirty years, low productivity, high unemployment especially among young people and women. However, there is another phenomenon that should give cause for concern: that of self-employed workers.

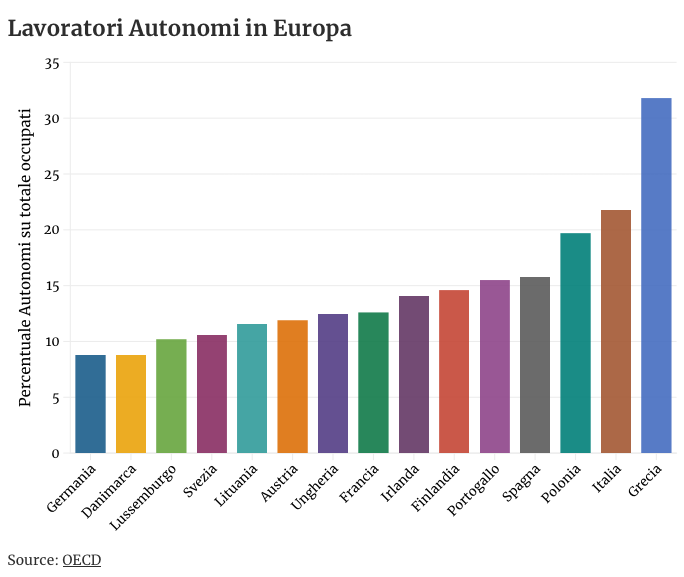

According to the data OECD, in fact, the incidence of self-employed workers (i.e. the number of self-employed out of the total number of workers) is clearly higher in Italy than in our European partners: 21.8% of the workforce would in fact be classified as self-employed, against a European average of 14.5%. Even more merciless is the comparison with reference countries such as Germany and France, at 8.8 and 12.6 respectively.

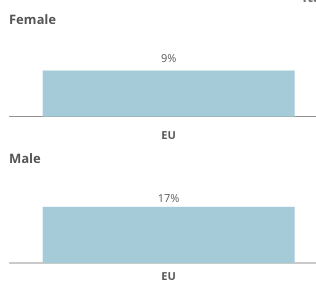

The data of CEDEFOP (European Center for the Development of Vocational Training), allow a more granular analysis of the phenomenon. In line with what emerges at European level, also in Italy more men are classified as self-employed workers: 15% for women and 24% for men,

The data of CEDEFOP (European Center for the Development of Vocational Training), allow a more granular analysis of the phenomenon. In line with what emerges at European level, also in Italy more men are classified as self-employed workers: 15% for women and 24% for men,

while in Europe the average is 9% and 17%.

while in Europe the average is 9% and 17%.

More interesting, however, is the difference by educational qualification. In our country, the highest incidence of self-employed workers concerns low-skilled and highly-skilled people. On the other hand, the sectors in which the density of self-employed workers is higher allows us to better understand these data: if on the one hand we have lawyers and architects, on the other hand there are professions that do not require qualifications.

What are the problems?

Given the high incidence of the self-employed on the workforce in our country, it is necessary to ask ourselves what are the problems that arise from it and above all what the solutions could be.

The main problem is obviously that of fake VAT numbers. Although they are self-employed, the work of these fake VAT numbers is purely an employee: employee hours, permanent work in the studio or company, without however the benefits of employee work. A particularly felt phenomenon for example among architects: the Instagram page Reorganization of the Architects has shown over the years the difficulty for architects to enter various studios as employees, thus leaving only the path of the VAT number open. This is not typical only of small provincial studios, they explain, but also of renowned studios which, while boasting very few employees on paper, then present a vast plethora of collaborators in their presentations on the official website.

As they explain lawyers Danilo Lombardo and Raffaella Calamandrei, it is not easy to discern a subordinate relationship from an independent one especially in certain sectors. At first, explains Calamandrei, the Fornero labor reform of 2012 intervened to try to stem the phenomenon, clarifying the conditions for work to be considered subordinate: a fixed place of work, for example a reserved position in the study, the specification of the collaboration and conditions on turnover.

Later also the Jobs act intervened trying to regulate the matter and counter the phenomenon. Even today, however, the situation is somewhat unstable from a legal point of view. But it is from an economic point of view that the situation becomes more dramatic.

Later also the Jobs act intervened trying to regulate the matter and counter the phenomenon. Even today, however, the situation is somewhat unstable from a legal point of view. But it is from an economic point of view that the situation becomes more dramatic.

The use of VAT numbers depends both on the flexibility with which the employer can terminate the contract compared to an employee and on the lower costs it entails. While these are often viewed as scourges affecting the Italian labor market, studies show that there are heavily negative effects of labor market flexibility on productivity. The use of false VAT numbers contributes to worsening the dynamics of our country's productivity.

VAT number, says Michele Razzetti on Vanity Fair, that's not a problem in itself. There are many professionals, both in the field of architecture and in other fields, who from VAT numbers manage to have both economic and professional success. On the contrary, however, the false VAT numbers incorporate the worst sides of both worlds: on the one hand the low salaries and the lack of autonomy of employees, on the other the lack of protection. These are two other problems that politics and public debate should pay attention to.

First of all, therefore, there is the issue of protection for VAT numbers, despite the fact that over the years there has been an improvement from this point of view, with the Jobs act of self-employed workers, of the Gentiloni government which recognized a series of rights for self-employed workers. And then with the introduction in 2021 of the ISCRO, a redundancy fund for self-employed workers: the pandemic has had a serious effect on the category, left alone in the face of uncertain prospects. On the other hand, the lack of protection is, according to experts, one of the factors that is driving the decrease in VAT numbers in our country.

Then there is the need for a network to plug into. Self-employed workers, unlike employees, are often characterized by an approach to portfolio, then with a number of different customers. Often, however, those who want to become self-employed lacks assistance to build this network of contacts. This leads to an extremely competitive system with no way out, especially for sectors such as cultural work. A sector devoid of protection and outlets in which there is more and more talk of gods anxiety problems, stress and deterioration of the mental health of those involved.

Finally, there is the issue of taxation. Over the years, precisely by virtue of the high presence of self-employed workers, successive governments have introduced tax reforms in some way to accommodate self-employed workers. In particular the introduction of the flat-rate scheme. The aim was also to simplify the jungle of concessions that previously included the minimum regime or that of new production initiatives, just to give two examples.

The flat-rate regime provides for a single tax rate of 15%, with the exception of falling to 5% for new businesses below a certain threshold, a sort of flat tax for self-employed workers. At first, the Renzi government set various limits for the various categories of self-employed workers. With the passing of governments, however, this threshold was raised first to 65,000 euros and finally by the Meloni government to 85,000 euros.

The flat-rate regime provides for a single tax rate of 15%, with the exception of falling to 5% for new businesses below a certain threshold, a sort of flat tax for self-employed workers. At first, the Renzi government set various limits for the various categories of self-employed workers. With the passing of governments, however, this threshold was raised first to 65,000 euros and finally by the Meloni government to 85,000 euros.

Why is this a questionable tax regime? In fact, the problem lies precisely in the very idea of flat tax, a workhorse of the right who would like to reform the IRPEF by pushing the country in that direction. Going into detail, the main problem of the flat tax on the self-employed concerns in particular the threshold value. Since up to a certain value (which we have seen to be 85,000 euros) the self-employed worker enjoys preferential taxation, this encourages evasion and avoidance. In fact, the self-employed worker will try to reduce the tax base on which he will then pay taxes in order to return to the interested party.

This is demonstrated by the data on tax evasion. According to the data of Report on the unobserved economy and on contributory tax evasion, it is precisely the IRPEF from self-employment that is mostly evaded. Furthermore, while in recent years we have seen a decrease in tax evasion in Italy and a decrease in the propensity to evade VAT, the IRPEF from self-employment has seen an increase of the same by 3.2% between 2015 and 2019.

However, the problems of taxation of VAT numbers are not finished. On the one hand, the high uncertainty on the threshold, which is periodically used by politics for mere electoral calculation, leads to considerable difficulties in compiling the business plans; on the other we are often talking about a small number of VAT numbers. According to the calculations of the ACTA association, the recent reform of the flat-rate regime desired by the Meloni government would affect 2.7% of VAT numbers, around 100,000 taxpayers out of a total of over 3 million. A somewhat incomprehensible choice if one considers that there is a large part of self-employed workers who are considered as workerorre poor. While the Meloni government has thought of acting by effectively cutting taxes for the more affluent, it has done nothing for the workers most in difficulty.

No less important is the difference in treatment between employed and self-employed workers: a self-employed worker with the same income pays up to three times less than an employee, this already in the face of a substantial difference with respect to tax evasion.

Self-employment and entrepreneurship

Despite the problems just expressed, self-employment enjoys a fair amount of popularity  especially among the very young. A recent survey carried out on recent graduates shows how a good majority of young people are aiming for self-employment or entrepreneurial experience. Only the 25% of young people is aiming for an employee job, while the 35% has not yet dissolved the reserve. On the one hand, the fact that young people want to pursue an entrepreneurial or self-employed career is commendable and appreciable, but at the same time one wonders whether the painting is the result of a certain narrative or an objective assessment of the working situation.

especially among the very young. A recent survey carried out on recent graduates shows how a good majority of young people are aiming for self-employment or entrepreneurial experience. Only the 25% of young people is aiming for an employee job, while the 35% has not yet dissolved the reserve. On the one hand, the fact that young people want to pursue an entrepreneurial or self-employed career is commendable and appreciable, but at the same time one wonders whether the painting is the result of a certain narrative or an objective assessment of the working situation.

On the other hand, in Italy for years the myth of the permanent job, agitated more by newspapers and culture than by the population, no longer exists, outclassed by dreams of wealth and "self made man”. A hope that however collides with an almost non-existent social mobility: in Italy those who are born poor remain poor. And which perhaps manifests the desire for redemption with respect to a world of work based increasingly on low wages, working hours that are irreconcilable with private life and scarce career opportunities. This desire, however, risks remaining irreconcilable with reality.

__________________________

Note

The "false VAT numbers"

Law n.92/2012 has defined two types of employment contracts: subordinate and self-employed.

Law n.92/2012 has defined two types of employment contracts: subordinate and self-employed.

This distinction arises from the need to stem an ever-growing phenomenon: that of fake matches VAT which conceal collaborations of a completely different nature, in which the element of subordination is found.

The expression "subordinate work" means a relationship whereby the worker undertakes to make his work available to an employer in a continuous and subordinate, receiving in return a remuneration for the activity carried out, the protection of the rights established by law (e.g. paid holidays and sickness, compensation in the event of involuntary dismissal, periods of expectation for serious reasons, etc.) and social security coverage.

Therefore, by entering into a subordinate employment relationship with a company, the worker undertakes a "relationship" bound by a contract, aimed at establishing - among other things - the number of working hours and the salary received. Conversely, if the same subject decides to open a VAT number to collaborate with a company, a public body, etc., he still has a contract to regulate his work, but he will be free to choose how and when to dedicate himself to it, with the only constraint being the achievement of objectives.

A self-employed contract is different from any employment. With a self-employment contract, no one will ever be able to force you to follow the hours, days and places of work. At most, they will be able to suggest you choose a useful day to spend in the company and/or indicate intermediate deliveries, thanks to which you can better organize the workflows. Working on your own means having the possibility to establish timetables, dictate economic requests and choose the most comfortable position. In fact, it is a choice that many make to have greater flexibility. When we talk about false VAT numbershowever, any distinction becomes complex: sometimes, those who choose to take the path of economic freedom then find themselves having to stay in the office for the "canonical" eight working hours or to comply with very stringent rules.

The Law makes a difference between those who can be considered gods false VAT numbers and individuals who carry out “atypical” self-employment. The following are exempt from the obligation to identify a specific project:

- commercial agents;

- professionals enrolled in a Register (e.g. lawyers, doctors, psychologists, biologists, etc.);

- members of administrative bodies (such as statutory auditors);

- those who receive old-age pensions;

- collaborators of Public Administrations;

- who carries out collaborations with Associations.

Article n.69-bis of Legislative Decree n.276/2003 allows to identify the false VAT numbers. In fact, unless proven otherwise by the customer, the services performed by workers in possession of VAT number they are reclassified as employment relationships if they occur at least two of the following conditions:

- the collaboration lasts for more than 8 months for two consecutive years (precisely, 241 days even if not consecutive);

- the fee deriving from this activity constitutes more than 80% of the annual fees received by the practitioner;

- the collaborator has a fixed workstation at one of the client's offices;

In the case of Scientific Representatives, a distinction must be made between scientific representatives of prescription drugs who must follow Legislative Decree 219/06 and scientific representatives of parapharmaceuticals, meaning generically with parapharmaceuticals the substances and products commonly sold in pharmacies (OTC, supplements, nutraceuticals , dermocosmetics, milk for babies, devices, etc.).

In the case of Scientific Representatives, a distinction must be made between scientific representatives of prescription drugs who must follow Legislative Decree 219/06 and scientific representatives of parapharmaceuticals, meaning generically with parapharmaceuticals the substances and products commonly sold in pharmacies (OTC, supplements, nutraceuticals , dermocosmetics, milk for babies, devices, etc.).

In the case of Pharmaceutical Representatives (ISF) the law does not prescribe the type of employment contract to which they must comply, therefore both the subordinate employment contract (chemical CCNL) and the self-employment contract are possible. However, the ISF (subordinate or self-employed) is prohibited from any sales activity and therefore, if self-employed, cannot be classified as a commercial agent.

On the other hand, parapharmaceutical sales reps are not bound by law so, even if both subordinate and self-employed contracts can be applied between them, the distinction is between those who have direct sales activities for whom, if self-employed, the agency contract and those who have no sales activity.

In all cases, the phenomenon of false VAT numbers which actually hide real employment relationships is widespread.

This is due to the fact that in the labor market there continues to be a profound difference in treatment and protection between subordinate workers, to whom all labor protection and social security regulations and the rights established by law and by collective bargaining apply, and workers hired with other forms of contract.

Co.co.co., interns, trainees, VAT numbers: there are many forms of personnel recruitment which, due to the type of contract used, do not allow the worker to have access to a whole series of fundamental rights, such as unemployment , sickness, maternity, etc.

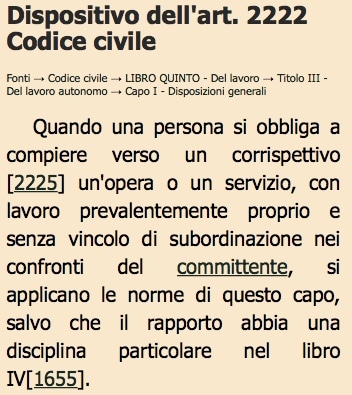

VAT numbers are, according to the law, self-employed workers, i.e. those workers who, without any subordination constraints, take on the task of carrying out a work or professional service in favor of the client, without being permanently included in the company organization . The self-employed worker, at the deadline set in the self-employment contract, delivers the good or service to the customer and is paid with the agreed amount. At that point, once the payment has been received, the self-employed person issues an invoice in favor of the customer and independently pays the taxes and social security contributions to his/her reference social security institution.

The false VAT numbers are those workers who, despite being formally employed as self-employed workers, are actually real ones subordinate workers as, in the actual performance of the relationship, they carry out their work in the manner typical of employee work.

There are a number of elements that characterize the method of conducting the employment relationship from which it can be inferred that it is a false VAT number.

Among these elements we can indicate, among others, the fact that the self-employed worker hired with a VAT number:

- is subject to the employer's directives in carrying out the work;

- must respect a fixed working schedule;

- must go, to carry out the work, to the place indicated by the employer;

- uses the tools made available by the employer to render the service;

- must communicate in advance any absences;

- performs a completely similar activity to other colleagues hired as employees;

- is permanently included in the employer's corporate organization.

- must periodically report on its activity

The employment relationship with the false VAT number, on the initiative of the worker himself or through an assessment conducted by the inspection bodies of INPS, Inail or the Labor Inspectorate, can be reclassified into a subordinate employment relationship from the date of its inception.

From the requalification of the relationship derives the worker's right to receive the so-called pay differences (where existing), i.e. the difference between the remuneration that would have been due to the worker if he had been hired from the outset as an employee and the remuneration received as a VAT number.

Furthermore, INPS and Inail can ask the employer to pay all the social security and welfare contributions that he would have had to pay if the worker had been hired from the outset as an employee.

Finally, the employment relationship becomes an open-ended employment relationship, with all the consequences of the case in terms of modification of duties, transfer, dismissal, protection of the worker in the event of illness, accident, pregnancy, handicap, etc.

Related news: False VAT numbers. Two emblematic sentences