The "British medical journal" has published on February 15th last year an interesting analysis entitled "High drug prices are not justified by industry's spending on research and development"  are not justified by industry spending on R&D)

are not justified by industry spending on R&D)

[BMJ 2023; 380 doi: https://doi.org/10.1136/bmj-2022-071710 (Published 15 February 2023) Cite this as: BMJ 2023;380:e071710]

Here are the main points:

Concerns about the prices of new drugs have increased over the past decade. In the US, estimated net prices of new prescription drugs have increased from a median of around $ 1400 per year (£1200; €1300) in 2008 to over $ 150 000 per year in 2021.

Not only innovative drugs, but also old and common drugs have seen unexplained price increases: In the US, the list price of some insulin products more than doubled from 2007 to 2018, while a US government report identified 1216 products that had seen prices rise above inflation between July 2021 and July 2022, an average increase of 31.6%.

The biopharmaceutical industry has long argued that high prices are needed to support research and development (R&D) of new drugs. However, analysis of pharmaceutical company spending and products raises questions about the claim that high drug prices are needed to sustain valuable innovation.

Accounting rules make it difficult to compare pharmaceutical profits with other industries, but the data suggest that pharmaceutical companies are particularly profitable, even after adjusting for R&D spending as a share of revenues. There also appears to be a disconnect between product R&D costs and prices. One recent study found no association between how much pharmaceutical companies spend on research and development and the prices they charge for new drugs.

The justification for high drug prices also ignores the large public investments in drug discovery and development, which contributed to the basic and translational research underpinning all new drugs approved by the FDA from 2010 to 2016; more than a quarter of new drugs approved by the FDA from 2008 to 2017 were linked to public investment during the latter stages of development. This means that the company is potentially paying twice for new drugs, first in the form of publicly funded research and then through the high prices of the products.

Most of the industry's spending is not on research and development

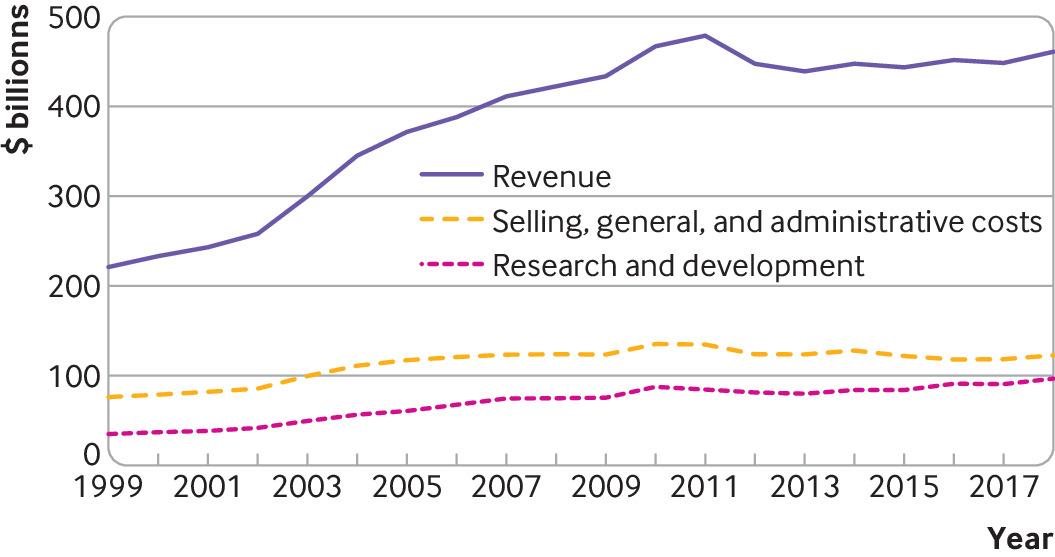

Based on publicly available financial reports from 1999 to 2018, the 15 largest biopharmaceutical companies had total revenues of $7.7 trillion. During this period, they spent $ 2.2 trillion on costs related to sales, general and administrative activities – a category that includes marketing and advertising, as well as almost all other business costs not directly attributable to the production of a product or the provision of a service – and $ 1.4 tr on R&S (fig 1).

The precise details of what is included in R&D and sales, general and administrative may not be clear. For example, companies may conduct seed trials of newly approved drugs as part of their reported R&D expenditure, but these have been described as having little or no scientific purpose, serving more as marketing strategies. Despite this limitation, it is clear that companies each year from 1999 to 2018 spent more on sales, general and administrative activities than on research and development, which is consistent with previous evidence from 1975 to 2007.

The precise details of what is included in R&D and sales, general and administrative may not be clear. For example, companies may conduct seed trials of newly approved drugs as part of their reported R&D expenditure, but these have been described as having little or no scientific purpose, serving more as marketing strategies. Despite this limitation, it is clear that companies each year from 1999 to 2018 spent more on sales, general and administrative activities than on research and development, which is consistent with previous evidence from 1975 to 2007.

Most of the same companies also spent more on buying their own stock, a practice known as stock buybacks, than on research and development during this period. Share buybacks are expected to drive up share prices and therefore benefit shareholders. These include senior corporate executives, whose income is often directly linked to the price of stocks (stock options). A survey of drug prices conducted by the US House Committee on Oversight and Reform showed that, from 2016 to 2020, the 14 largest pharmaceutical companies spent $577 billion on stock buybacks and dividends – 56 billions of dollars more than R&D – at a time when annual executive compensation grew by 14%. An earlier analysis by the Institute for New Economic Thinking, using data from 2006 to 2015, also found that 18 large US pharmaceutical companies spent more on stock buybacks and dividends than on research and development, apparently prioritizing the short-term financial returns versus long-term investments in innovation.

This trend reflects the increasing financialization of the pharmaceutical industry in recent decades, which has generally focused on maximizing shareholder value. "unproductive" cash on the books to shareholders. However, if excessive buybacks occur repeatedly over many years, it raises questions about commitments to truly valuable and risky biopharmaceutical research.

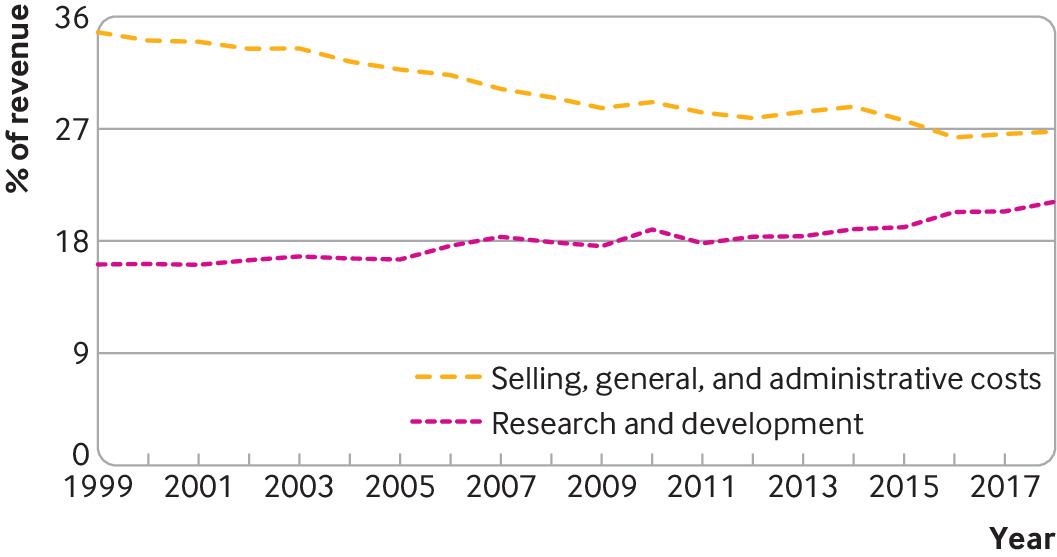

Although companies have spent more on sales, general and administrative activities and share buybacks than on research and development over the past two decades, selling, general and administrative expenses (as a share of revenue) fell from 35% to 27% in this period while R&D expenditure increased from 16% to 21% (fig 2). This is consistent with data from the 10 pharmaceutical companies with the largest R&D budgets between 2005 and 2015

On the bright side, most of the products under development during 1997-2016 targeted novel mechanisms of action. However, there has also been a shift in focus from blockbuster medicines typically targeting chronic diseases and sold in high volumes globally, towards “niche” medicines targeting rare diseases or narrow indications for which they may be charged. high prices. Publicly available FDA data shows that the percentage of drugs developed for rare diseases has increased from 25% of all approvals in 2001-05 to 48% in 2016-20. In 2021, orphan drugs accounted for 52% of all approvals. This is likely true in part because companies have targeted additional market exclusivity and other incentives granted for rare disease drugs, coupled with issued licensing requirements for drugs targeting unmet healthcare needs and increased buyers' willingness to pay. for these products.

On the bright side, most of the products under development during 1997-2016 targeted novel mechanisms of action. However, there has also been a shift in focus from blockbuster medicines typically targeting chronic diseases and sold in high volumes globally, towards “niche” medicines targeting rare diseases or narrow indications for which they may be charged. high prices. Publicly available FDA data shows that the percentage of drugs developed for rare diseases has increased from 25% of all approvals in 2001-05 to 48% in 2016-20. In 2021, orphan drugs accounted for 52% of all approvals. This is likely true in part because companies have targeted additional market exclusivity and other incentives granted for rare disease drugs, coupled with issued licensing requirements for drugs targeting unmet healthcare needs and increased buyers' willingness to pay. for these products.

Many healthcare needs remain unmet by the current pharmaceutical business model. This includes neglected diseases, antimicrobial resistance and other emerging infectious diseases. In many major markets, the current system rewards new products regardless of comparative advantage or contribution to public health priorities, partly reflecting the fact that regulators evaluate new medicines based on their individual risk-benefit ratio rather than that show added clinical value. Furthermore, patents are awarded on the basis of the chemical novelty and inventiveness of the product, regardless of the added therapeutic value.

Related news: The most expensive new drug in the world ($ 3.5 million) has been approved by the EU. And it saves money

In November 2009 the President of AIISF he wrote:

… the prescriptive role of the specialist doctor becomes increasingly strong, the new products introduced on  market are increasingly oriented towards specialist and hospital management areas that are much more profitable and require a very small number of ISFs and much lower fixed costs. In this context, the ISFs, not requalified by the establishment of a Register or by an adequate profile in Legislative Decree 219, and reduced to a pure profit instrument, will serve less and less. A few FSIs who will attend specialized centres, and others, with atypical or flexible contracts, to be used for purely commercial purposes will suffice.

market are increasingly oriented towards specialist and hospital management areas that are much more profitable and require a very small number of ISFs and much lower fixed costs. In this context, the ISFs, not requalified by the establishment of a Register or by an adequate profile in Legislative Decree 219, and reduced to a pure profit instrument, will serve less and less. A few FSIs who will attend specialized centres, and others, with atypical or flexible contracts, to be used for purely commercial purposes will suffice.

Globalization, understood as the financialization of the economy, the reform of the labor market, the attack on trade unions, the liberalization of capital movements, enters the philosophy that underlies many decisions and choices of pharmaceutical companies. This philosophy has transformed companies from, so to speak, social institutions in which the interests of workers, owners, local communities, the State, suppliers intertwined, into pure cash flows. The dominant criterion is the maximization of shareholder value. The only thing that matters to the shareholder is the market value of the company as indicated by the share price. The interests of workers, suppliers, local communities are irrelevant. Just as irrelevant are the criteria that once indicated the success of a company, such as the size achieved, turnover, number of employees, technological leadership, market position.

It is evident that what is spent on distributing dividends, interest, "stock options", is not available for productive investments, least of all in research and development since the latter promise relatively distant and uncertain returns. Investors can't wait that long. The company must continuously produce profits and capital gains. Hence the acquisitions and mergers to compensate for the research deficit, hence the not hiring employees with stable contracts, hence the pressure for workers and unions to demonstrate "wage moderation", hence the closure of production units whose performance, even if high, it is lower than the average of competing companies, hence the recourse to transfers of business units, mobility and collective redundancies. It is no coincidence that when operations of this kind are announced, the shares of the company that made the announcement go up.

It is no coincidence that stocks in the “Pharma” sector have gained 14% since the beginning of the year. In this scenario, drug sales representatives are the ones who pay the highest price in terms of employment. Even if the number of layoffs, redundancies, redundancy payments, branch transfers is high  business, goes almost completely unnoticed by the general public. If we talk about unemployment we talk about it in general terms as a consequence of the economic crisis and never of our particular situation. The unions show all their weakness by going into negotiations to obtain economic incentives as much as possible, but they hardly succeed in safeguarding employment. We ISF are individualists, resigned and we are unable to affect the trade unions, Farmindustria or the state or health authorities. It's time to react. This state of affairs is no longer tolerable.

business, goes almost completely unnoticed by the general public. If we talk about unemployment we talk about it in general terms as a consequence of the economic crisis and never of our particular situation. The unions show all their weakness by going into negotiations to obtain economic incentives as much as possible, but they hardly succeed in safeguarding employment. We ISF are individualists, resigned and we are unable to affect the trade unions, Farmindustria or the state or health authorities. It's time to react. This state of affairs is no longer tolerable.

It will therefore be necessary to ensure that the authorities take note of this state of affairs and intervene to declare a crisis in the sector and favor the conditions for creating job alternatives linked to professionalism. It will be necessary to safeguard employment and it will also be necessary to redesign Legislative Decree 219, which penalizes us precisely on the employment level. It will be necessary to redesign the rules that guarantee as much as possible the professionalism based on ethics and transparency of the ISFs to ensure that the same ISFs resume that role of Scientific Representatives on Drugs which is useful to both the doctor and the patient.